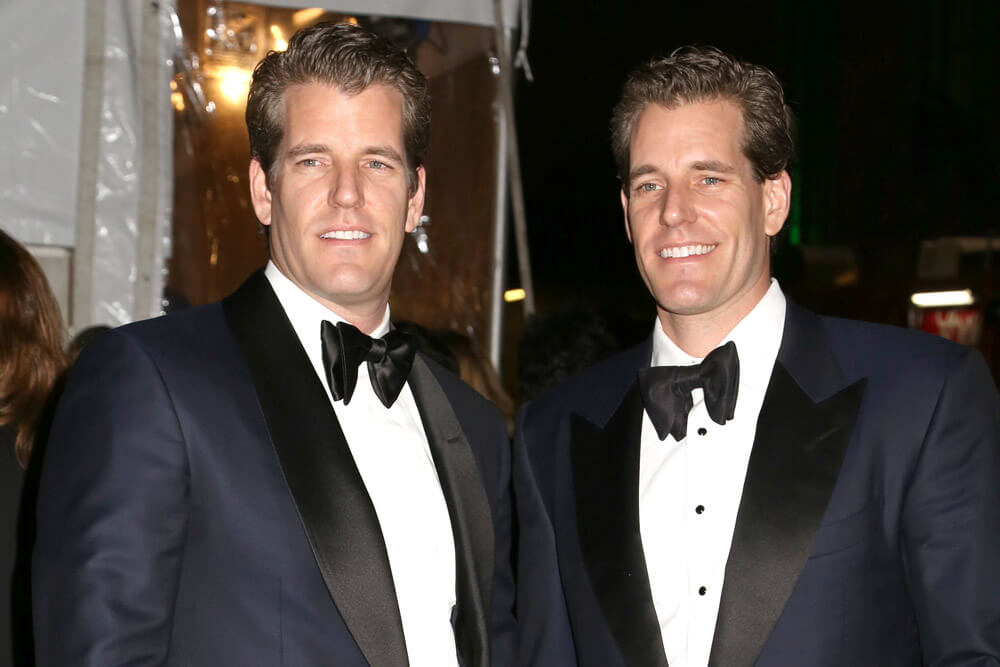

The Winklevoss twins are among the biggest and most well-known cryptocurrency advocates, and as of late, their fortunes have increased significantly thanks, in part, to the bitcoin rally that has been occurring since April of this year.

The Winklevoss Twins See Their Investments Grow

The plight of the twins first came to light in the Oscar-winning film “The Social Network,” which detailed the creation of Facebook, arguably the world’s largest and most used social media platform. The twins and the film allege that Facebook was originally their idea, and that Mark Zuckerberg – current head executive of the company – was merely a programmer that they asked to do technical work and coding for the system.

However, the film suggests that Zuckerberg created the platform and passed the idea off as his own, which resulted in both the twins and Zuckerberg heading to court. Zuckerberg ultimately settled the dispute with the Winklevoss brothers, and all parties went their merry ways.

Since that time, both Cameron and Tyler Winklevoss have moved on to establish solid reputations in both the crypto and monetary spaces. They have since created what’s known as the Gemini Exchange in New York, a cryptocurrency trading platform and one of the first recipients of the now infamous New York-based Bitlicense which many companies and traders said halted innovation in the cryptocurrency space and within the Big Apple.

The twins haven’t allowed this to get in their way. They are also solid bitcoin investors and have experienced heavy gains in their cryptocurrency fortunes over the past few months since bitcoin first began its present bull rally in April of 2019. At press time, their combined net worth – which is comprised mostly of digital assets – has reached $1.45 billion. Pretty serious, considering this same worth was approximately $645 million at the beginning of the year.

In addition, the market stability and trends affecting bitcoin this time around appear a lot more legitimate than was witnessed in 2017. Qiao Wang, director of product at the crypto data startup Messari, explains:

The confidence is certainly returning. The difference between now and the last time bitcoin reached $13,000 is that the market is currently far more rational… Bitcoin is digital gold and a hedge against inflationary economic crises. If investors believe in this thesis, they should slowly accumulate bitcoin and hold it for years to come. They should not go all-in or trade frequently.

The Market Is Stronger, More Mature

Larry Cermak, director of research at the Block, boasts similar sentiment, saying that the crypto market has become somewhat “tame and rational” in recent months. He states:

There’s no evidence that it’s coming from one country. If I were to make an educated guess, the rally was started by larger investors and sustained by some retail investors.