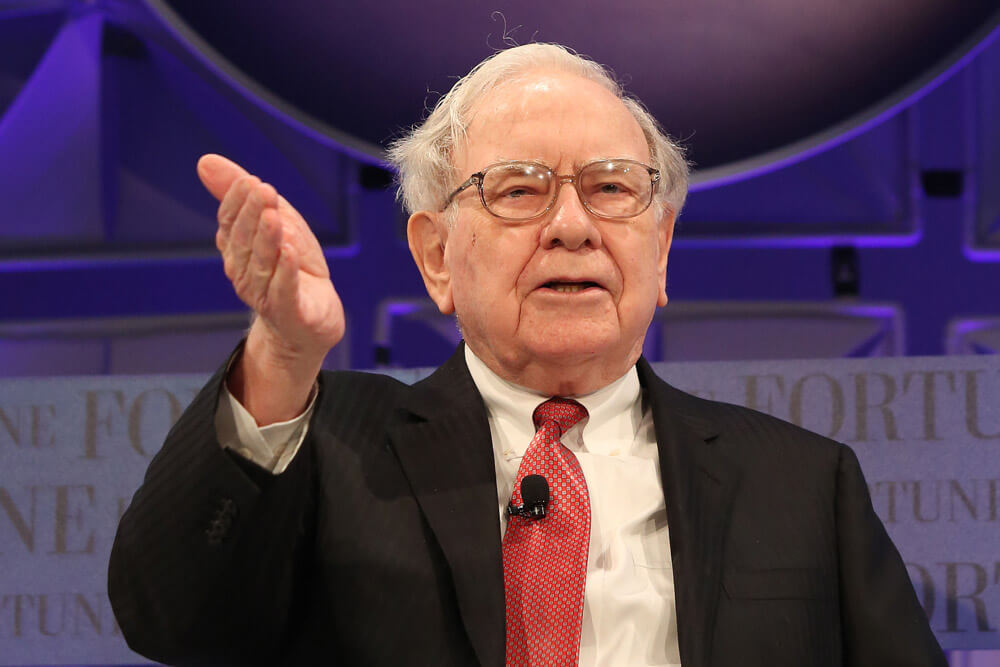

Bitcoin has been doing quite well as of late. The currency recently hit a price of $30K for the first time in about 11 months and the asset has shot up steadily since the beginning of the year. Sadly, this has not been enough to convince Warren Buffett – a long-time crypto critic – of its worth, and he’s doubling down on his hatred and skepticism of the world’s number one digital currency by market cap.

Warren Buffett Still Doesn’t Care About BTC

In a recent interview, he compared buying bitcoin to gambling or playing the lottery. Buffett said:

I didn’t like chain letters when I was a kid. I thought, ‘Why in the world should I send along a chain letter?’ […] I’ve seen people do stupid things all my life, and I really, I empathize with that. I mean, people like to play the lottery […] People love the idea that they’re going to make more money tomorrow.

He has stated in the past that bitcoin will not amount to a darn thing. He has gone so far as to refer to it as “rat poison squared,” and he doesn’t think the currency has any real value to it, at one point even comparing selling bitcoin to trying to sell a button of one’s own shirt. Buffett continued with:

I looked at all these people, who had flown thousands of miles to do something that [was] unintelligent as fast as they could. They thought the dice were hot or something like that, and I thought, ‘I’m going to get rich in this country.’ I mean if that’s what people do. I can be smarter than that.

He also says the only real reason anybody gets involved in bitcoin or other forms of crypto is because they see their neighbors are making money and they begin to experience FOMO (fear of missing out). At the end of the day, however, he believes this is never a reason to get involved in a potential investment, and people aren’t doing their research or due diligence enough. He said:

It really drives them crazy if their next-door neighbor is making more money not knowing what they’re doing and they’re just sitting there, and their spouse is saying, ‘Why is that guy getting a second car, and why are we missing this whole thing?’ The gambling instinct is so strong.

Avoid Investing in Film Ventures

When it comes to other negative investments, he said that the movie and entertainment industries sit in this category in that while moviemakers and everyone involved in the working elements tend to do well, the shareholders don’t. He commented:

Streaming is not really a very good business. The people in entertainment have made lots of money. The shareholders really haven’t done that great over time.