SUI surged over 110% in the past month as the Sui blockchain recorded over $1 billion in TVL. With that, the SUI token almost hit $200 million in trading volume on October 3.

Sui (SUI) has rallied massively over the past 30 days, recording a price increase of more than 110% on October 5. The token has taken off from a low of $0.78 last month to go up to $1.73 at the time of writing. It also went close to $2 on October 4 but pulled back the following day. That price rise took it close to its March 27 all-time high (ATH) of $2.18.

To compare, bitcoin (BTC) went up by about 10% during the same time to $62,300. The overall crypto market’s market cap only rose by less than 5%. SUI was one of the top-performing tokens among the top 100 by market cap this past month, reaching second place behind Bittensor (TAO).

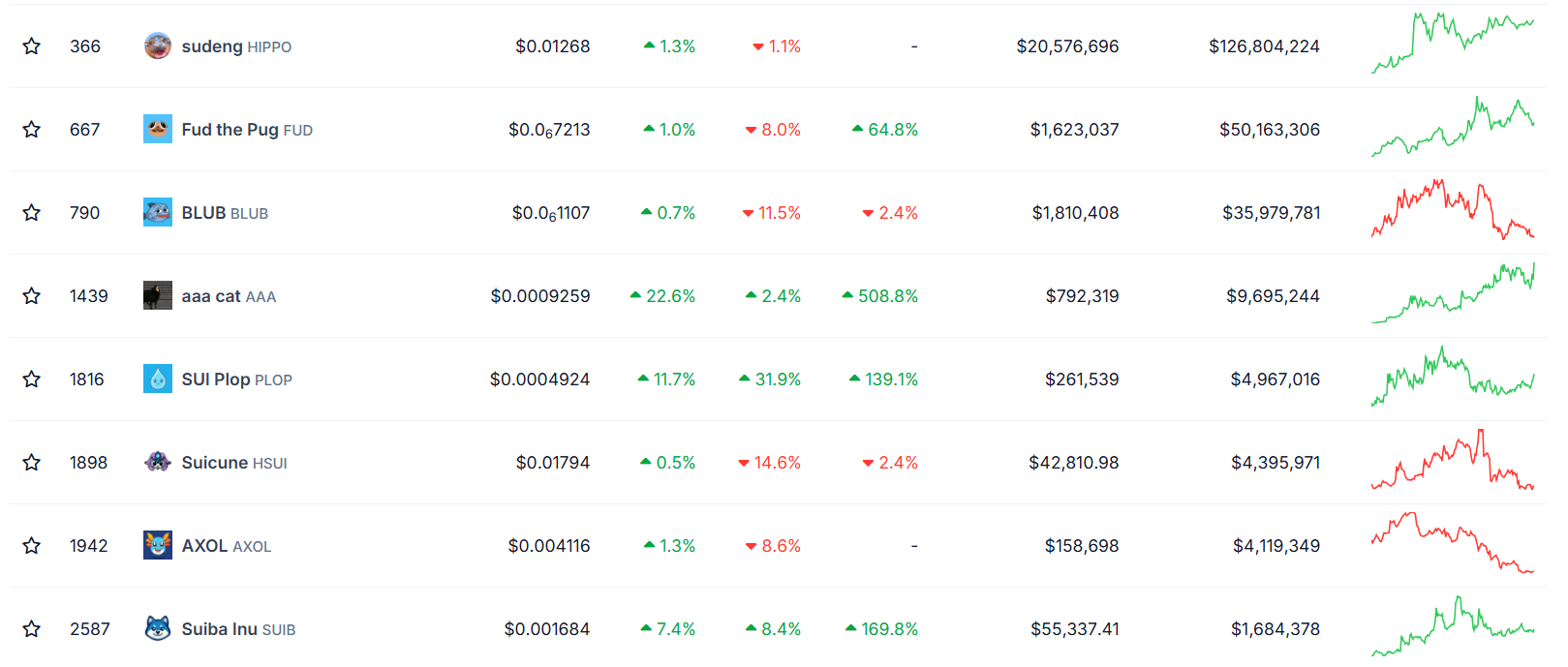

A reason behind SUI’s value taking off to such levels comes from the memecoin frenzy occurring on the layer-1 blockchain it is native to—Sui. The past 24 days have been an exceptional period for Sui-based meme tokens, as they outperformed the broader crypto market. Sui’s memecoin ecosystem rose by over 23% in the last 24 hours to climb to over $243 million.

The aaa cat (AAA) memecoin had the most explosive seven-day growth, growing by 508%. Sui’s Shiba Inu counterpart, Suiba Inu (SUIB), gained 169% in the same period. However, this memecoin explosion has not been reserved for the Sui ecosystem. Solana, Base, and TON have all experienced similar growth to their memecoin niches, with memecoin interest being high across the board throughout 2024.

Source: CoinGecko

Beyond memecoins, the Sui blockchain also did great with other metrics. On October 3, the SUI token volume went very close to registering $200 million, DefiLlama shows. That is a 661% spike since September 3. DefiLlama also shows that Sui exhibits a total value locked (TVL) of more than $1 billion, depicting massive user engagement.

Could the USDC Integration Have Aided Sui’s Recent Boost?

While Sui has attracted a huge developer and user base as it provides near-instant transaction confirmations and inexpensive gas fees, the recent Circle co-stamp must have helped it witness increased usage. Circle deployed its USDC stablecoin natively on the network in mid-September when its TVL was at $650 million. That metric increasing to $1 billion after the USDC integration cannot be a coincidence.