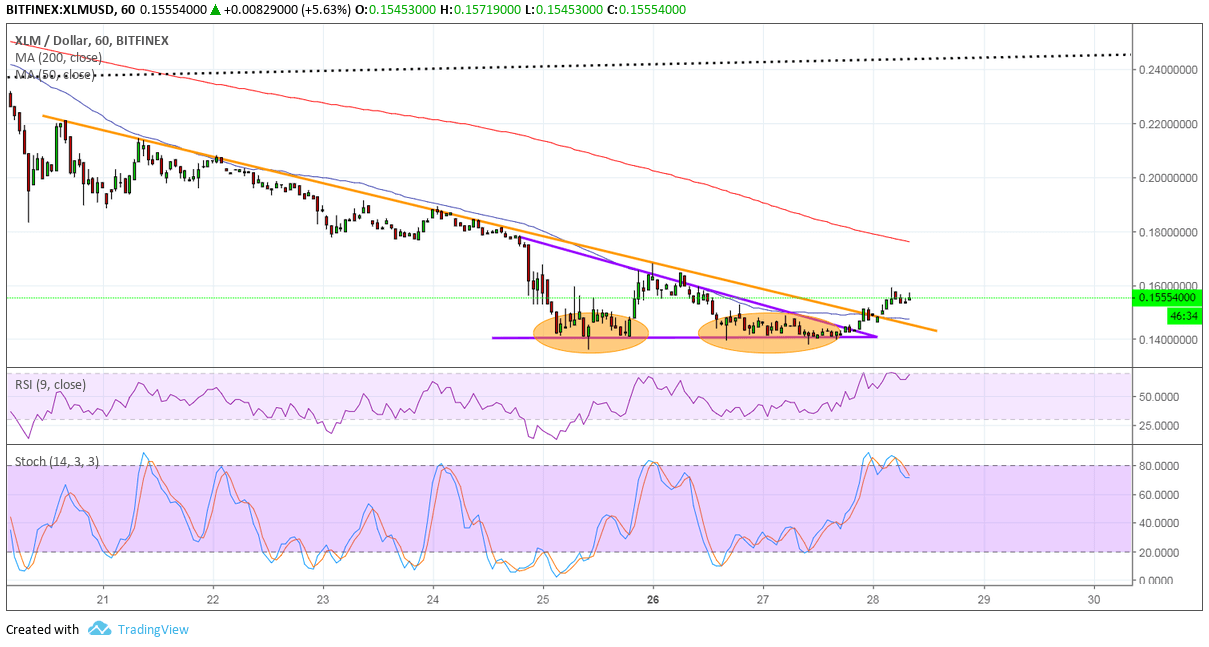

Stellar has recently broken above a short-term descending triangle consolidation pattern and also a descending trend line. Price has also closed above the 100 SMA dynamic resistance as another bullish signal.

A double bottom reversal pattern appears to be forming, and Stellar has yet to test and break past the neckline around 0.17 to confirm that an uptrend is in the works. From there, Stellar could test the dynamic inflection point at the 200 SMA and a break higher could accelerate bullish momentum.

Note, however, that the 100 SMA is still below the longer-term 200 SMA to indicate that the path of least resistance is to the downside. In other words, the selloff is more likely to resume than to reverse. If the nearby resistance levels keep gains in check, Stellar might find its way back down to the bottoms at 0.14 or even lower.

Stellar was among the biggest losers for the previous week, joining the likes of Cardano and Bitcoin Cash, but it seems poised for a big recovery this time. There has been a notable improvement in sentiment for the entire cryptocurrency industry, and Stellar has been able to take advantage of this turn.

The bullish breaks are being attributed to renewed confidence in institutional investments in the industry. Although the SEC feedback on Bitcoin ETF applications was seen as a downer, market participants seem to have focused on reports that Nasdaq is set to launch Bitcoin futures. SEC Chairman Clayton said that the lack of investor protections makes it unlikely that the regulator will approve a Bitcoin ETF anytime soon.

Still, traders might keep holding out for bigger developments before piling on more long positions or perhaps wait and see how regulators impact institutions participating in the industry next year. With the end of the year approaching, profit-taking may also soon come into play.

Images courtesy of TradingView.