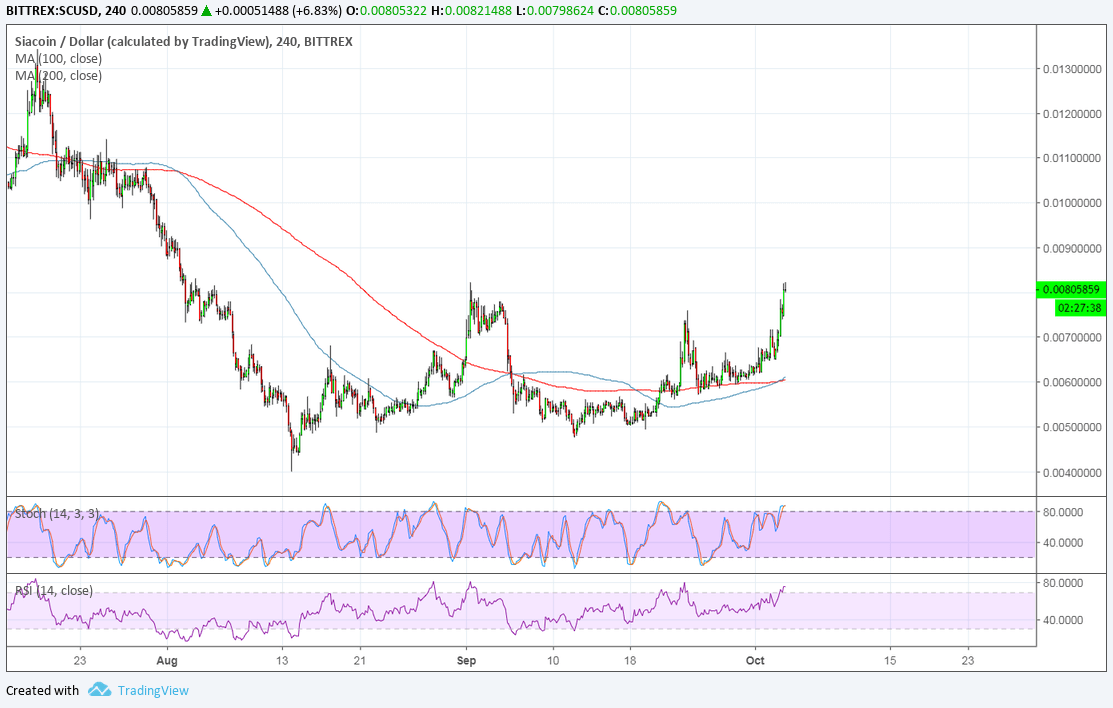

Siacoin has been up more than 20% in the past 24 hours, currently testing the neckline of its double bottom formation on its 4-hour chart. This reversal chart pattern spans 0.0045 to 0.0080, so the resulting rally could be of the same height.

The 100 SMA is attempting to cross above the longer-term 200 SMA to indicate that the path of least resistance is to the upside. This basically means that the uptrend is more likely to gain traction than to reverse. Siacoin is also above the moving averages, which means that these would likely hold as dynamic support.

Stochastic is heading up to show that buyers are in control, but the oscillator is already dipping into overbought territory to reflect exhaustion. Turning back down could mean a return in bearish pressure or a possible drop in price. Similarly, RSI is on the move up but also approaching overbought territory. This has yet to turn lower to reflect a pickup in selling momentum.

Siacoin has had a bullish reaction to the decision to take back their original ruling of allowing Bitmain and ASIC mining rigs to command SC blockchain, with the developing team assuring that they will reset the Proof-of-Work function block Bitmain and Innosilicon hardware. This potentially opens up ways for developers to xpiate the hashrate for the miners.

However, some dissenters have pointed out that the hard fork shows that Siacoin is forking out the competition. After all, only the Obelisk mining hardware will be able to mine Siacoin, which means that they could have a monopoly over the network.

Still, the team clarified:

The purpose of Proof-of-Work is to make attacking the network expensive. It is a service provided by miners to benefit the network. And while miners are typically handsomely rewarded for the service they provide, this reward does not exist as some inalienable right for the most successful miner. If the network’s miners are parasitic, abusive, monopolistic, or otherwise inhibiting the success of the network, the network has every reason to kick them out.

Images courtesy of TradingView