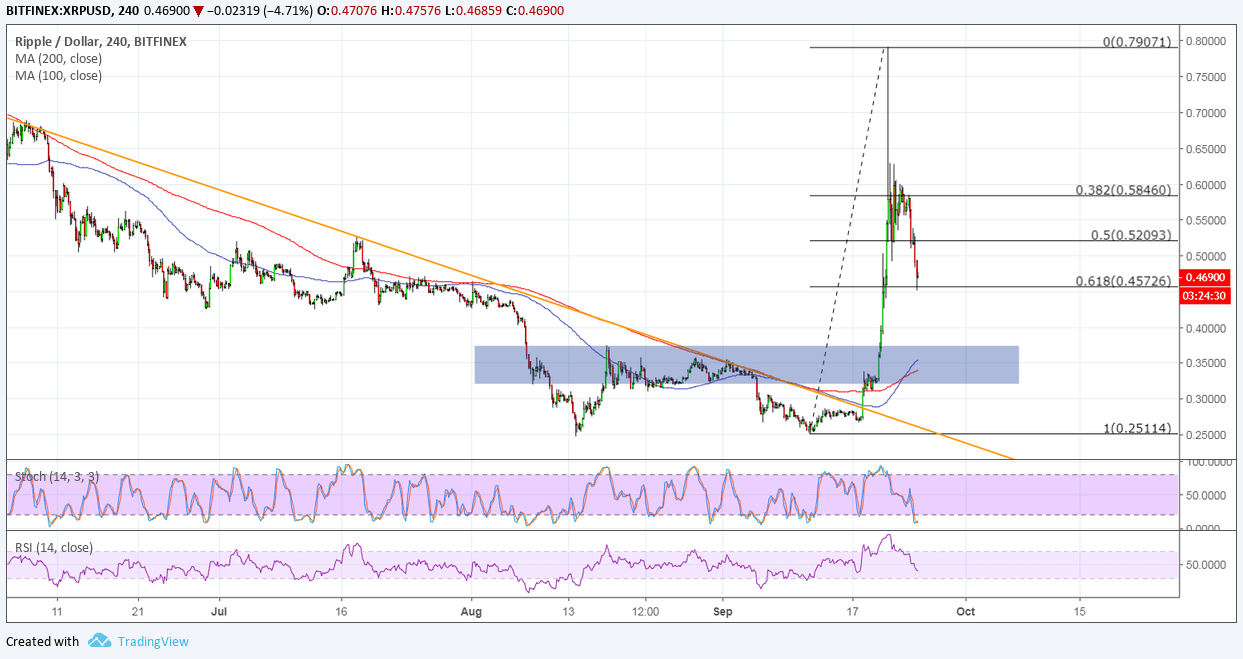

Ripple recently made a strong upside break from its long-term slide, indicating that an uptrend is due. However, the pullback from the sharp move was similarly swift, pushing the price down by roughly 17% in the last 24 hours.

Price is stalling from the slide likely because it is down to the 61.8% Fibonacci retracement level based on the latest surge. If this keeps losses at bay, Ripple could make its way back up to the swing high near the .8000 mark and beyond.

A larger correction, on the other hand, could find support at the broken double bottom neckline around .3500. This is also in line with the moving averages’ dynamic inflection points. On the subject of these, the 100 SMA just crossed above the longer-term 200 SMA to confirm that the path of least resistance is to the upside or that the uptrend is more likely to resume than to reverse.

Stochastic is pointing down to show that sellers are in control, but the oscillator is also dipping into oversold conditions to signal bearish exhaustion. Turning back up could draw buyers in and allow the rally to resume. RSI is also heading lower so Ripple might keep following suit as this oscillator has plenty of room to slide before hitting oversold levels.

Ripple got a strong boost last week from remarks by its exec on the upcoming launch of xRapid. This platform would use Ripple or XRP as a bridge for cross-border transactions, thereby allowing banks or other counterparties to save on time and costs in settlement.

This upbeat outlook was followed by an announcement that PNC would be joining xCurrent, which is a real-time messaging platform for transaction updates. Many are speculating that Ripple clients on xCurrent would likely be transitioned to xRapid after its launch, which would mean a huge market and strong volumes on the digital asset.

Images courtesy of TradingView