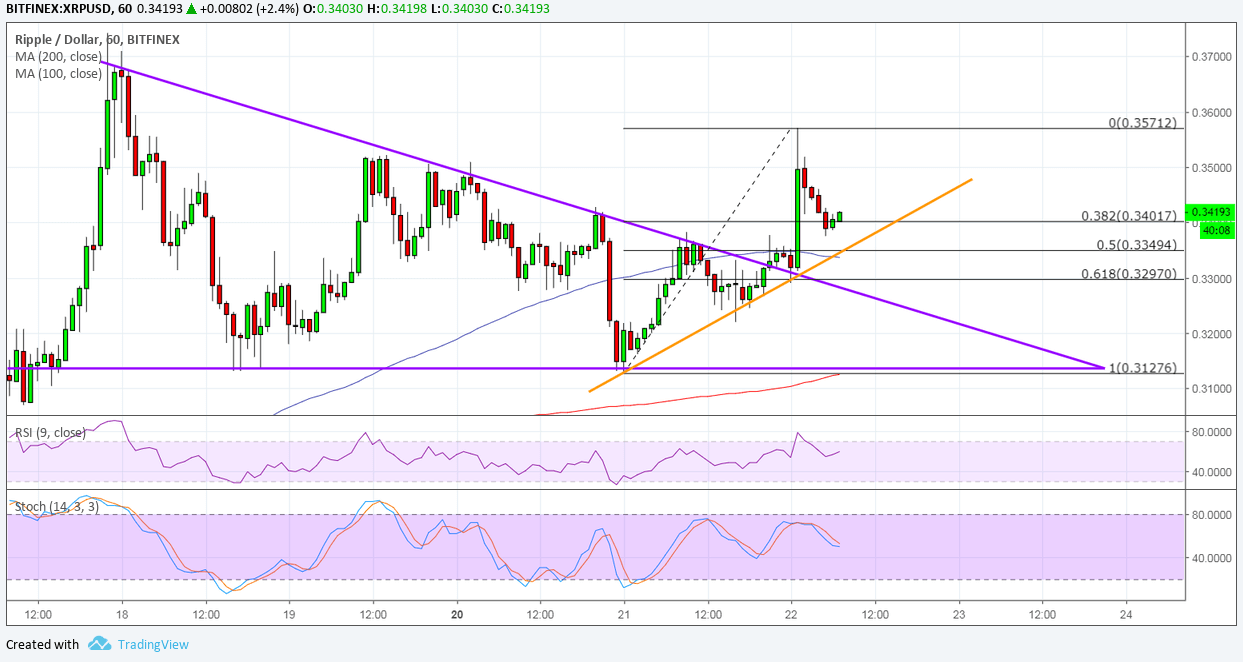

Ripple was able to break out of its descending triangle consolidation pattern to signal that more gains are underway. Price hit a ceiling at 0.3570, though, so a correction may be due before bullish momentum picks up.

Using the Fibonacci retracement tool on the latest swing low and high shows that the 50% to 61.8% levels are close to the broken resistance, which might now hold as support. Price is also moving in a short-term ascending trend line, which lines up with the 38.2% Fib that can hold in a shallow correction.

The 100 SMA is above the longer-term 200 SMA to confirm that the path of least resistance is to the upside. This indicates that the rally is more likely to resume than to reverse. This also lines up with the short-term trend line, adding to its strength as a floor also.

RSI is turning lower after previously indicating overbought conditions. This means that bearish pressure could be returning and might take Ripple much lower. A move below the 61.8% Fib could push the price back inside the triangle or even for a test of the bottom at 0.3127. Stochastic is also on the move down without hitting overbought levels, suggesting that sellers are eager to return.

The upside break is being attributed to the listing of Ripple on Bittrex to be traded on the USD market. This pair, along with ETC/USD, is available to eligible corporate and personal account holders.

After the announcement was made public, Bittrex added:

Today’s announcement is another exciting step toward further adoption of blockchain technology, which is truly revolutionary. In addition to broader acceptance, expanding fiat markets to the top digital currencies on our trading platform will help limit the dominance and influence of any one token over other blockchain projects – a necessary evolution if we’re going to unleash blockchain’s potential benefits for consumers and businesses.

Images courtesy of TradingView.