Funding scientific research within various academic institutions is often a relatively complicated issue that involves disparate and conflicting interests. For example, private universities currently outspace public institutions in attracting big, prestigious grants. Inequities also stretch to research studies funded with corporate, government or military interests favoring special kinds of inquiry.

A recently published paper presented a novel way to fund scientific research via using cryptocurrencies. Even though it does not represent a full funding solution, staking of cryptocurrecy coins can be invested to generate compound interests. These coins utilize masternode technologies in order to collateralize the cryptocurrency blockchain network and accelerate transaction pace. Furthermore, the staked coins will incentivize masternode holders via paying them dividends; as such, institutions, or even individuals, that buy such forms of central hubs have the chance to engage in a profiting dividend reinvestment plan.

The Proposed Model for Research Funding:

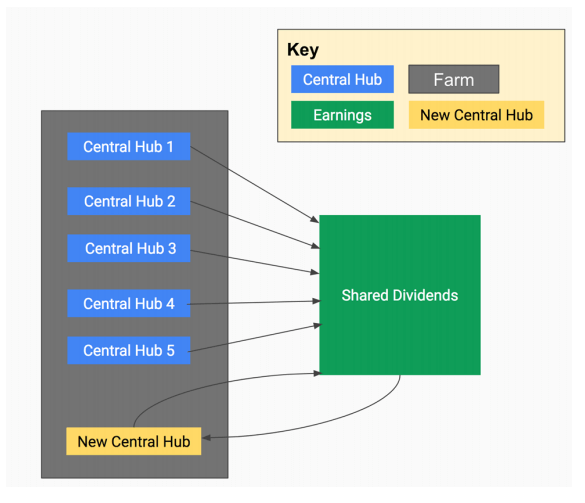

The below figure illustrates the model presented in the paper. The model shows how Dash and PIVX could be used to fund scientific research. The model shows how central hubs, also known as masternodes, could function to generate capital. The model highlights how central hubs will generate dividends, as is the case within the shared pool. Whenever these dividends accumulate to a certain threshold that permits acquiring a new central hub, a new central hub will be created, yielding even more dividends.

The model underscores implementation of coin staking for the purposes of research funding. It offers a non-static means that leverages the technologies of software engineering in scientific research, while also generating compound interests. The model is not theoretical, as over the past 10 months, the developers of the model tested it and proved that it can generate enormous monetary gains.

The model holds great potential to help in funding scientific research, yet the model prototype has to be extensively tested and should currently serve as a portfolio diversifier, rather than a full funding solution.