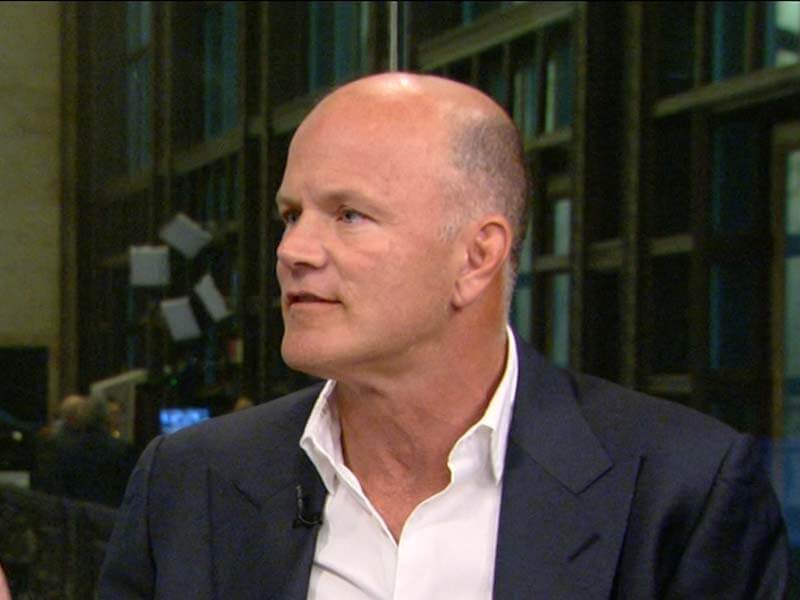

Just a few days ago, bitcoin – the world’s number one digital currency by market cap – experienced a nasty price drop that saw it fall from about $52,000 per unit to roughly $45,000 per unit. The currency is experiencing a slow period of recovery at this time given that it has only jumped back above $46K, and according to Mike Novogratz – a hedge fund manager and crypto investor – the bitcoin plunge was the result of traders simply getting too excited about what was going on in the space.

Mike Novogratz On What Caused BTC to Fall

One of the big happenings in the news as of late is that El Salvador, a country in Central America, was working to make bitcoin legal tender in the nation. This was all set to occur and be solidified on Tuesday, September 7, though things got off to a nasty start with the nation’s Chivo wallet experiencing heavy technical glitches that saw nobody able to access or spend their assets.

At the time, bitcoin was trading in the $50,000 range, but everyone got so excited and up in arms about what occurred with the wallet system that it ultimately reacted negatively to the poor hype and decided to cross bearish lines into the mid-$40,000 range. That’s a fall of roughly 17 percent.

Novogratz believes that the time has come for traders to learn once and for all that speculation and over emotion in the space can lead to bitcoin making some very big – and odd – maneuvers. In a recent interview, he stated:

I think we just got too excited, and this was a little air being popped out of the balloon. The market got too long… There’s lots of retail money. A lot of it’s leveraged. There was about $4 billion of liquidations that happened in a short period of time… That’s mostly leveraged offshore in places like FTX and Binance.

Novogratz also points out that many leading companies – such as Amazon and Walmart – were quick to post blockchain-related jobs in recent weeks, suggesting that the digital currency space is set to become far more mainstream and legitimate. In addition, credit card giant Visa has purchased a non-fungible token (NFT) for approximately $150,000, meaning the financial firm is now stepping into the world of decentralized money.

We Must Give El Salvador a Chance

At the time of writing, Novogratz is confident that the bitcoin drop is only temporary, and that El Salvador simply needs time to work out whatever kinks and glitches it’s dealing with. He says issues like this often happen when new products and tools are provided to the public, and thus we cannot allow present circumstances to mar our opinions of El Salvador’s capabilities. He states:

Whenever you’re doing a new technology rollout, there are glitches. Come back in six weeks or 12 weeks and let’s talk about how it’s working.