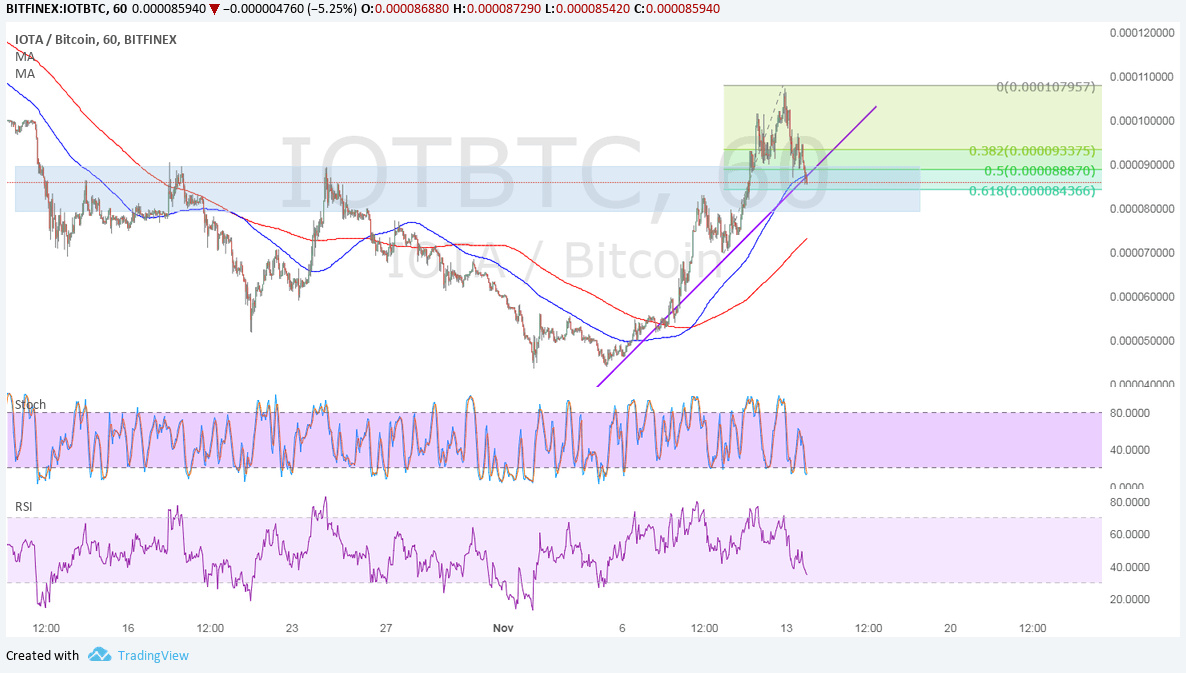

IOTA continues to trend higher against the dollar and bitcoin but is currently pulling back from its climb. Against bitcoin, price is testing an area of interest or former resistance around 0.00009.

This lines up with an ascending trend line connecting the lows since the start of the month and the 100 SMA dynamic support. This moving average is above the longer-term 200 SMA to confirm that the path of least resistance is to the upside or that the uptrend is more likely to continue than to reverse.

This is also around the 50% to 61.8% Fibonacci retracement levels which might continue to hold as support. A break below these levels or 0.00008, on the other hand, could mark the start of a reversal and send IOTBTC down to the lows near 0.00005.

Stochastic is pointing down to show that selling pressure is in play. RSI has plenty of room to head south also so IOTA might follow suit until both oscillators turn higher from oversold levels to reflect a pickup in bullish pressure.

Against the dollar, IOTA is also in an uptrend and testing the Fib levels. The rising trend line connecting the latest lows lines up with the 50% level at 0.5500. Price is also nearing the 100 SMA dynamic inflection point.

The 100 SMA is above the 200 SMA also, which means that the uptrend is likely to resume at some point. In that case, IOTUSD could climb back to the swing high just below the 0.6500 mark.

However, stochastic is on the move down to signal that sellers are on top of their game. RSI is also moving lower so the pair could follow suit. Both are approaching oversold levels to indicate exhaustion among bears and a potential return in bullish pressure.

Bitcoin has sold off following news of the hark fork suspension as this could leave rival cryptocurrencies with more ammunition. Meanwhile, the dollar has been tossing and turning on tax reform updates, with the Congress vote scheduled for Thursday.