IOTA continues to enjoy downside pressure against bitcoin and the dollar, but more so against the former. IOTBTC is right at its very record lows while bitcoin enjoyed a stellar rebound this week.

Earlier on, there have been speculations that the CFTC is looking into regulating bitcoin so price took a strong hit against the dollar. However, technical levels still held and investors took this as a chance to buy bitcoin at much cheaper levels, thereby affecting its price action against other rivals like IOTA.

Price is still below the 100 SMA on the daily time frame, though, so the path of least resistance is to the downside. In addition, the recent consolidation looks like a bearish flag or potential continuation signal.

Stochastic is pulling up to indicate a potential return in buying pressure. RSI is also starting to pull up from the oversold level so IOTA might follow suit. If so, price could head up to the next area of interest at 0.00012.

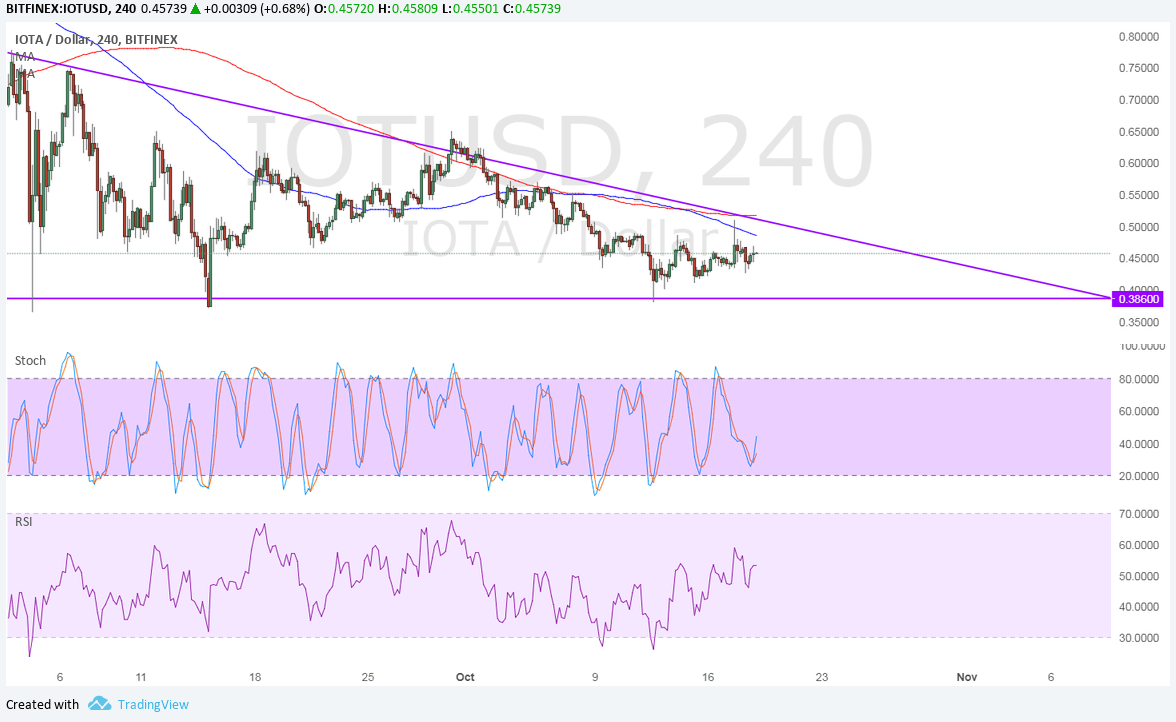

Against the dollar, IOTA appears to be consolidating inside a larger descending triangle formation and is moving up to test the resistance. The 100 SMA is below the longer-term 200 SMA so the path of least resistance is to the downside.

Price already seems to have bounced off the 100 SMA dynamic inflection point, which might be enough to keep gains in check. A higher test of resistance could hit a roadblock at the 200 SMA near 0.5000.

Stochastic is pulling up without even hitting oversold levels, which means that buying pressure is returning. RSI is also on the move up but may hit overbought levels soon so selling pressure could take over.

The dollar is currently being pushed and pulled by speculations about the next Fed Chairperson. Trump is still scheduled to meet with current head Yellen but is also looking into a more hawkish candidate than previously expected. The White House has said to expect an announcement in the ‘coming days’ so his pick could have a significant impact on dollar action across the board, including IOTUSD.