IOTA continues to trend lower against bitcoin as resistance at the top of its descending channel held. Price has moved past the mid-channel area of interest and is now making its way towards support at 0.00014.

The 100 SMA is below the longer-term 200 SMA to signal that the path of least resistance is to the downside or that the selloff is likely to persist. These moving averages are also close to the channel resistance to add to its strength as a ceiling in the event of another pullback.

Stochastic is indicating oversold conditions, though, which means that buyers could return soon. RSI is on the move down but also dipping into oversold territory to signal that selling pressure is exhausted.

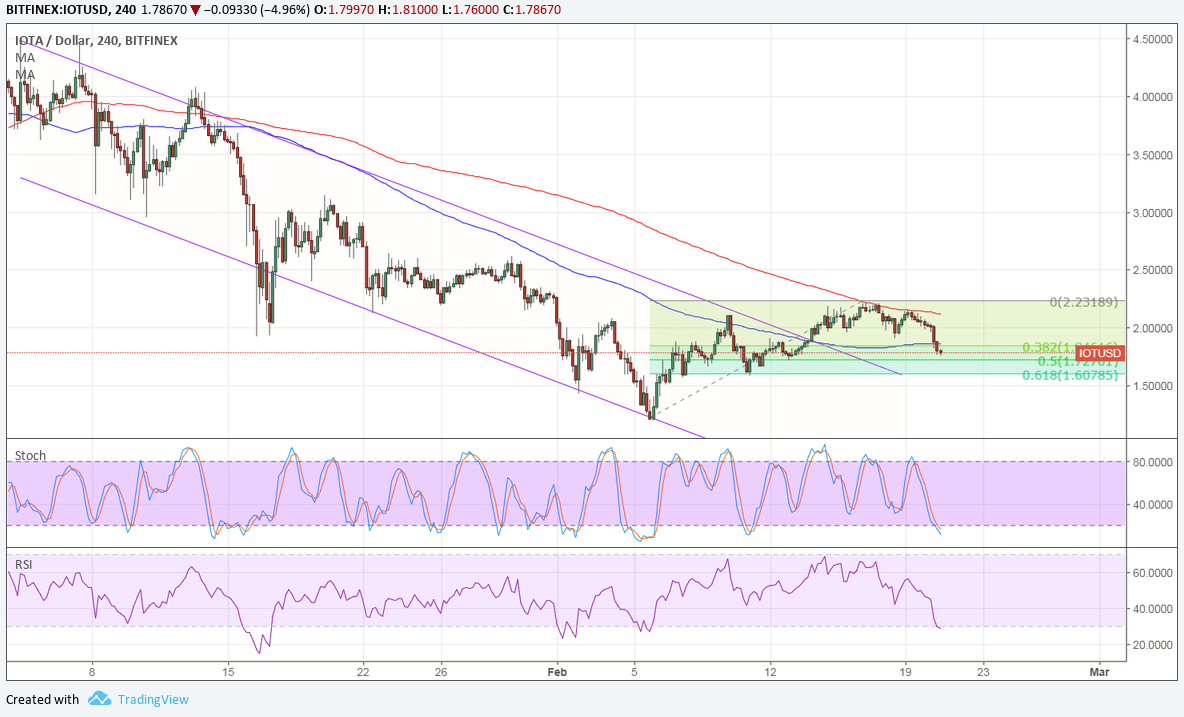

Against the dollar, IOTA has broken outside of its descending channel to indicate that a reversal from the earlier downtrend is underway. Applying the Fib tool on the latest swing low and high shows that the 61.8% level lines up with the broken resistance around 1.5000.

The 100 SMA is below the longer-term 200 SMA also, but the gap is narrowing to signal a potential upward crossover. This also confirms that buying pressure could pick up soon.

Stochastic and RSI are both on the move down so the correction could go on for a while. Both oscillators are nearing oversold conditions to show that sellers are starting to get tired and buyers might take over. If so, IOTA could move to the swing high against the dollar, which is near the 200 SMA dynamic resistance.

The FOMC minutes are up for release today so it should be a volatile one for the dollar. Note that the US currency has been able to chalk up another winning day thanks to rising bond yields in the latest auction. Stronger Fed rate hike hopes could pave the way for another day in the green, especially if stocks and commodities chalk up more losses.