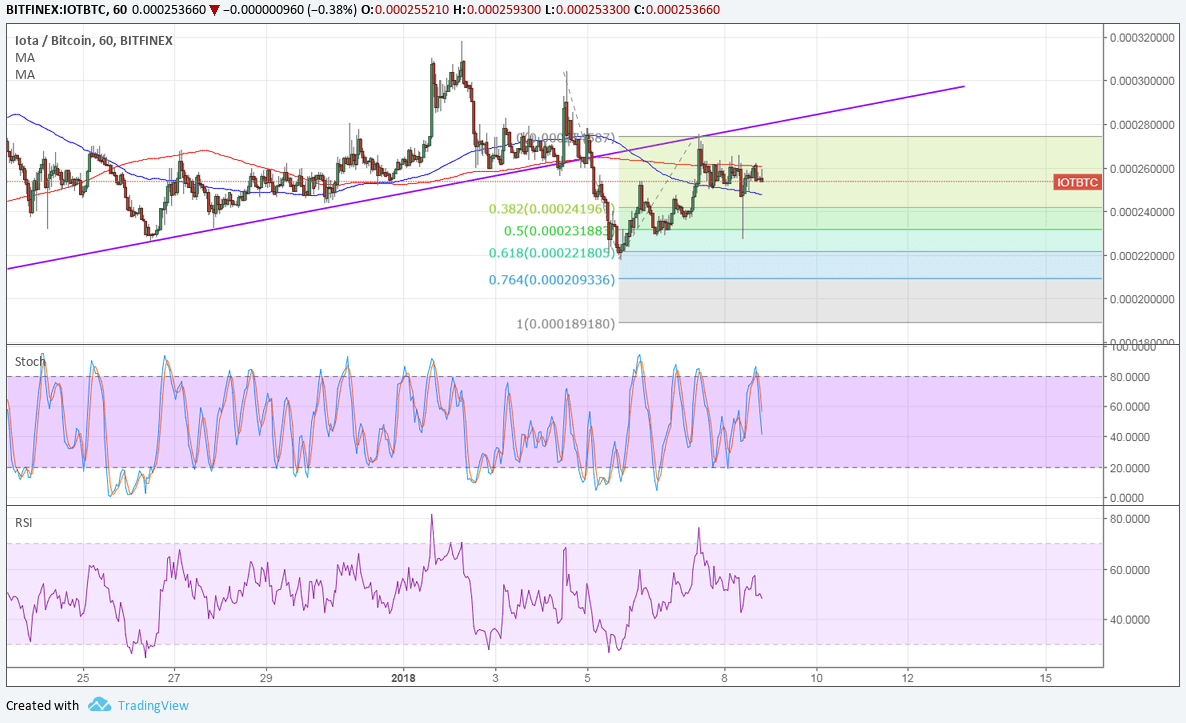

IOTA recently broke below an ascending trend line support against bitcoin and is completing a pullback. If the area of interest continues to keep gains in check, price could fall to the Fib extension levels illustrated below

The 38.2% Fib extension is at 0.00024 then the 50% level is at 0.00023. The 61.8% extension is at 0.00022 while the 76.4% extension is around 0.00021. The full extension is located at 0.00018.

The 100 SMA is below the longer-term 200 SMA so the path of least resistance is to the downside. This means that the selloff is more likely to carry on as bears gain traction. The 200 SMA has also held as dynamic resistance on the pullback.

Stochastic is on the move down to confirm that selling pressure is in play. RSI is headed south so IOTA could follow suit. Both oscillators have plenty of room to fall before hitting oversold conditions to indicate bearish exhaustion.

Against the dollar, IOTA bulls are putting up a good fight after bouncing off the channel support. Price is close to the mid-channel area of interest and could push higher to the resistance closer to 4.5000.

The 100 SMA is above the longer-term 200 SMA on the 1-hour time frame so the uptrend could persist, but the moving averages are also in the way and might hold as resistance.

Stochastic is turning lower to signal a return in bearish pressure but RSI has room to climb, so there are conflicting signals from the oscillators.

The US dollar took a hit from weaker than expected NFP data, which weighed on Fed rate hike expectations, but the currency was able to rebound on stronger consumer credit conditions. Equities also posted strong gains, allowing the S&P and Nasdaq to set new record highs again.

Looking ahead, FOMC rhetoric could continue to influence dollar movement with several speeches lined up. The main events aren’t scheduled until Friday, with many traders looking at the CPI for clues on future rate hikes.