The new IMF paper talks about implementing a robust framework at the legislative and central bank levels to accelerate CBDC adoption.

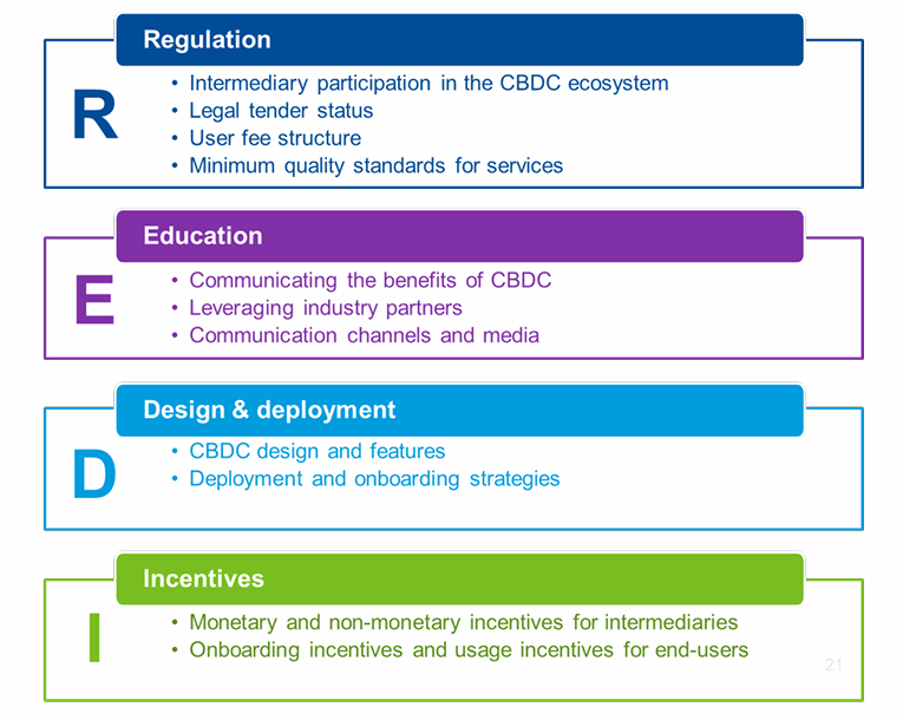

The International Monetary Fund (IMF) released a paper comprising a four-pronged REDI framework to help countries and their central banks better drive CBDC adoption in their geographies. Being four-pronged, REDI comprises IMF suggestions over sections like regulation, education, design & deployment, and incentives. The paper containing the suggestions was published on September 20, titled “Central Bank Digital Currency Adoption Inclusive Strategies for Intermediaries and Users.”

Source: IMF

REDI as a concept and framework was formulated by IMF staff to ensure financial inclusion within countries, which is often the first discussed benefit of CBDC. However, that cannot occur without considerable adoption by intermediaries and end-users. “Central banks should not take for granted that CBDC, once launched, will be adopted and scaled up easily. Among the countries that have launched CBDC or are conducting large-scale pilots, adoption remains slow and limited,” the paper read.

The IMF mentioned that this does not necessarily mean CBDC interest is low and its implementation globally is a failure. Instead, numerous barriers exist to its adoption, “such as a lack of public awareness and trust, privacy protection concerns, preference for existing instruments, and lack of appropriate incentives for attracting intermediaries.”

The Four Prongs

Thus, IMF staff came up with the REDI framework to address these exact concerns. The first aspect of REDI, regulation, considers policy-related strategies to bolster CBDC adoption.

Then, the education aspect emphasizes spreading awareness about these digital currencies to stakeholders, including intermediaries and end-users, to break down misconceptions and build trust. The responsibility to spread awareness, as the paper mentions, falls on central banks.

The third part of the framework, pertaining to design & deployment, speaks of making CBDC design appealing and easy to use to ensure maximum adoption. Furthermore, it mentions how central banks and regulators can “enhance deployment (roll-out) plans, streamline onboarding, and distribute and expand acceptance points to encourage CBDC adoption.”

As the paper gets to the final section of the framework, incentivization, it talks about providing benefits that motivate users to utilize CBDCs. Those benefits include monetary and non-monetary incentives, like subsidies to use the infrastructure, tax cuts, new sources of revenue by monetizing data from CBDC transactions, loyalty points, and more.