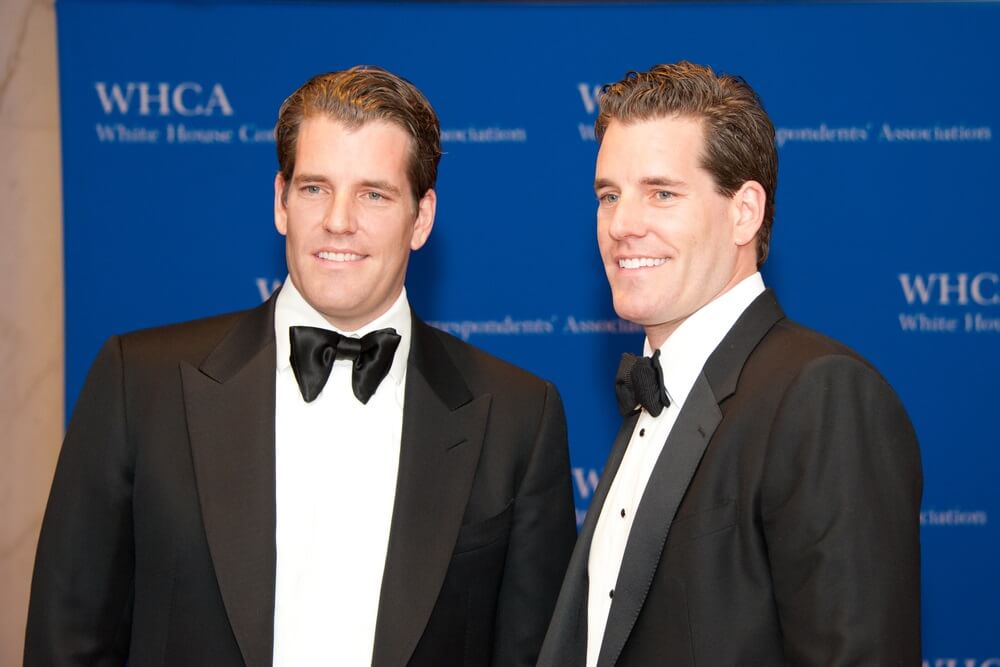

The bitcoin exchange created by Cameron and Tyler Winklevoss is teaming up with Nasdaq Inc., in a bid to boost defenses against bad actors.

Under an agreement, the Gemini Exchange will use Nasdaq’s surveillance software, SMARTS, to monitor the market for abusive trading practices, the Wall Street Journal reports.

Cameron Winklevoss, president and co-founder of Gemini, said in an interview that:

We’re doing this because we believe in the importance of creating a rules-based marketplace. We believe this is where things are headed.

News of the partnership comes at a time when global regulators are stepping up their efforts to look into the practice of how cryptocurrency exchanges operate. The U.S. Securities and Exchange Commission (SEC) is one agency that is taking a keen interest in the market.

Last week, it issued a subpoena against Riot Blockchain, a company that changed its name and business focus to blockchain and digital currency-related services last year. According to a report, the SEC requested ‘certain information from the company.’ Earlier this year, Jay Clayton, the chair of the SEC, revealed that it was looking closely at businesses that had moved into the sector.

At the time, he said:

The SEC is looking closely at the disclosures of public companies that shift their business models to capitalize on the perceived promise of distributed ledger technology and whether the disclosures comply with the securities laws, particularly in the case of an offering.

Such is the interest that the SEC is showing to the runnings of the cryptocurrency sector that several venture capital backers of digital currency companies have sought a broad oversight exemption from the agency, claiming it will slow digital coin growth.

Yet, with market manipulation a recurring issue in the digital currency market, the use of Nasdaq’s surveillance will provide assurance. The technology works by monitoring real-time market activity and then raises alerts when it detects unusual activity, the WSJ reports. The information that is received is then taken by humans who investigate the matter to determine whether the traders broke any rules.

With Gemini, the Nasdaq SMARTS technology will work by monitoring bitcoin and ethereum. It will also observe the auctions that the exchange holds at 4:00 p.m. ET to determine a daily benchmark price for bitcoin, the report added.

Notably, Gemini was one of 13 exchanges that received a letter and questionnaire from New York Attorney General Eric Schneiderman last week asking that they answer a series of questions about their practices. One of which was the safeguards the exchanges have in place to prevent manipulation.

Image from Shutterstock.