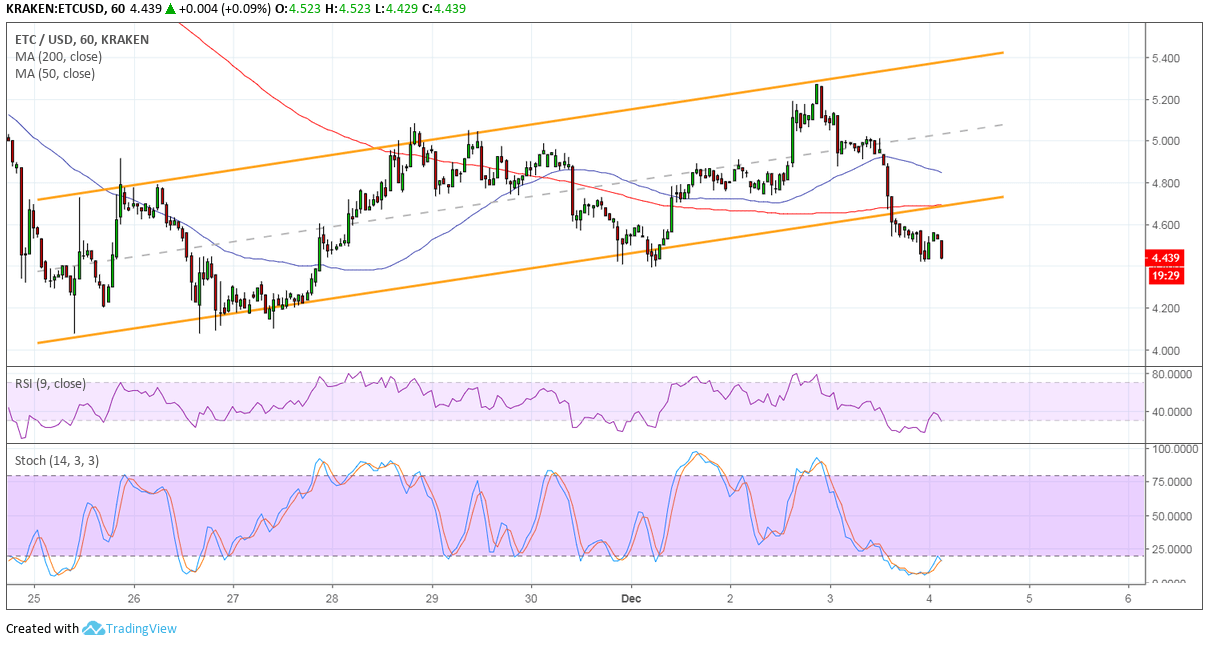

Ethereum Classic was previously trending up with its higher highs and higher lows inside an ascending channel. However, this uptrend came to a halt and a reversal may be due as price has closed below the channel bottom.

The 100 SMA is still above the longer-term 200 SMA to suggest that the path of least resistance is to the upside. In other words, the uptrend is more likely to resume than to reverse. The gap between the moving average is narrowing, though, indicating slowing bullish pressure and an imminent crossover. Price has also broken below the 200 SMA that lines up with the bottom of the channel as an early bearish signal.

RSI is pulling out of the oversold region to signal that exhausted and may be letting buyers take over. Stochastic also looks ready to climb out of the oversold region so a pullback may be in order. In that case, a retest of the broken channel bottom around 4.700 could be seen while stronger bullish pressure could carry it back inside the channel to resume the climb.

On its Twitter account, ETCDEV Founder and CTO Igor Artamonov announced:

It is with great regret that I communicate the shutdown of ETCDEV current activities related to Ethereum Classic, effective immediately.

As is publicly known we have struggled with funding our operations in the last few weeks. This was partially due to the market crash, combined with a cash crunch in the company.

Furthermore, he went on to share that they appealed to their investors for funding as well as external members of the ecosystem. They also attempted a community fund but weren’t able to secure enough short-term financing.

With that, it’s no surprise that traders are starting to dump their ETC holdings for fear of it being extinct soon. The recent market rout doesn’t seem to be bottoming out after all, as indicated by the recent breakdowns across the board.

Images courtesy of TradingView