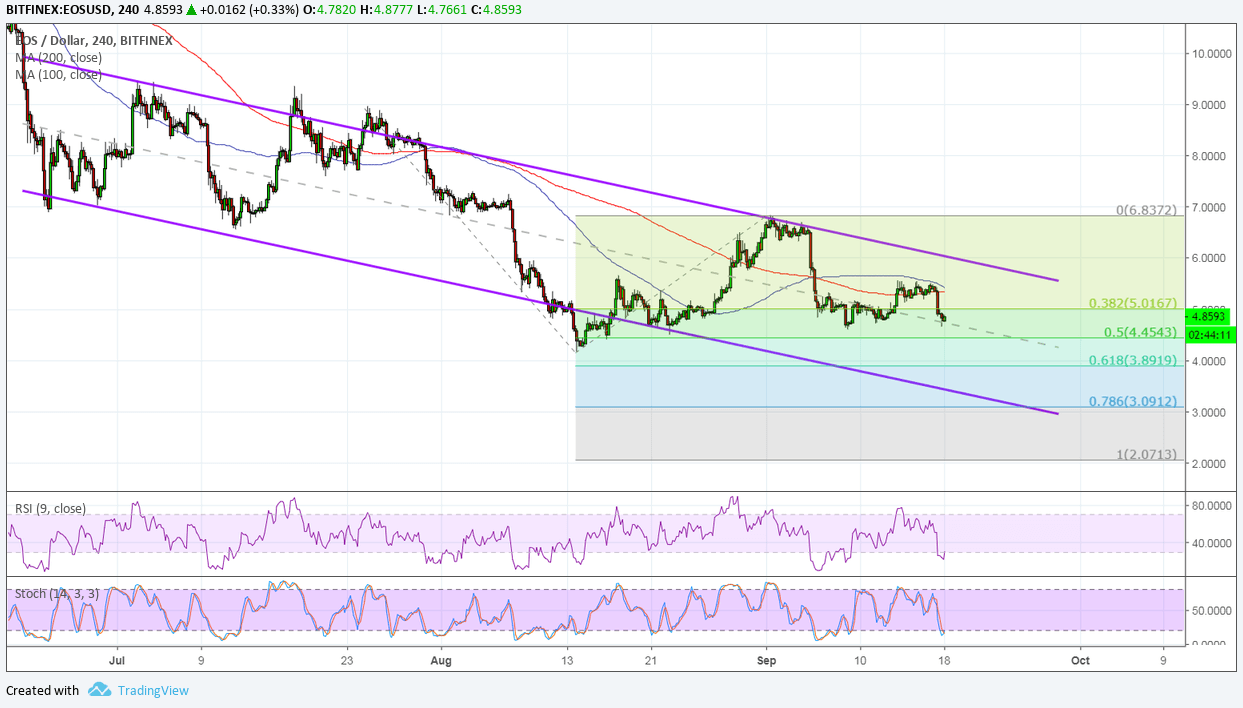

EOS continues to drift lower and looks prime for a break below the current Fib extension level. The price has formed lower highs in making another test of the 38.2% extension at the middle of the channel, possibly setting its sights on the actual bottom.

This lines up with the 78.6% extension just above the 3.0000 mark. Nearby support can be found at the 50% extension or 4.4543 and the 61.8% level that lines up with the 4.0000 level. Stronger selling pressure could take EOS down to the full extension at 2.0713.

The 100 SMA looks prime for a downward crossover from the 200 SMA to indicate a pickup in selling pressure. Then again, it looks like the moving averages are oscillating to reflect range-bound action. In that case, EOS might keep moving sideways and even make another test of the channel top, although the moving averages would likely hold as nearby dynamic resistance.

RSI is pulling up from the oversold region to signal a return in bullish pressure. Stochastic is still on the move down and dipping into the oversold region but has yet to turn higher to indicate that buyers are returning.

It has been reported that Bancor, which is one of the biggest dApps on Ethereum, is expanding to the EOS blockchain. This is due to the faster transaction time and lower fees compared to ethereum.

Dubbed BancorX, the project will allow users to trade between EOS-based tokens and also between EOS and ethereum tokens. According to the company’s post:

More than 15% of the total EOS tokens in supply have been used to validate the chain, activate its functions, and elect the first 21 block producers to serve and support the EOS blockchain.

As for LiquidEOS, it noted:

Bancor lowers the technical barrier to currency creation and gives dApps a mechanism to endow their tokens with automated convertibility to any currency. This will increase the adoption and usability of EOS-based projects.

Images courtesy of TradingView