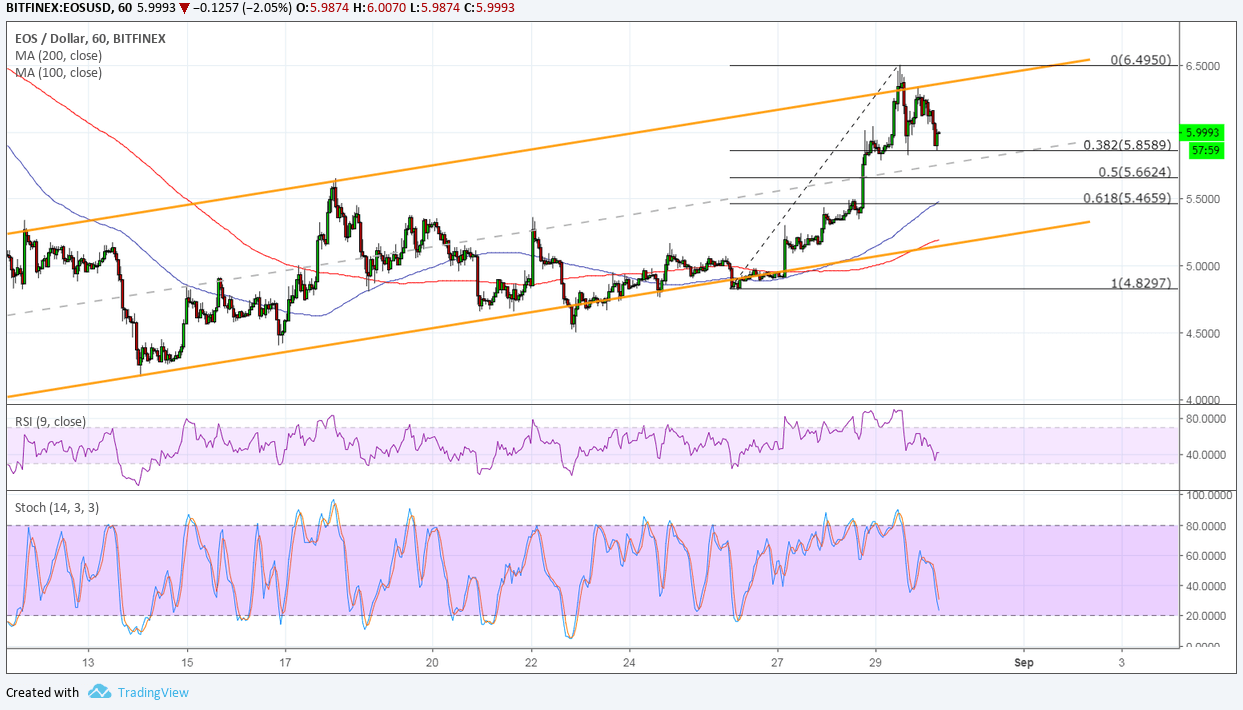

EOS got a strong boost from news that the group is already looking into the much-awaited referendum system for $35 million worth of tokens. Price hit resistance at the top of its ascending channel on the 1-hour time frame, though, so a pullback from the climb may still offer a better price to go long.

Applying the Fibonacci retracement tool on the latest swing low and high shows that the 61.8% level is closest to the channel support around the 5.5000 mark. This is also in line with the 100 SMA dynamic inflection point, which is above the longer-term 200 SMA to confirm that the path of least resistance is to the upside.

In other words, the uptrend is more likely to resume than to reverse. The gap between the moving averages is widening slightly to reflect strengthening bullish momentum. With that, the 38.2% Fib might even be enough to keep losses in check and allow price to resume the climb to the swing high around 6.5000 or beyond.

The 50% retracement level is closer to the mid-channel area of interest while the 200 SMA dynamic inflection point lines up with the channel bottom as the line in the sand for a correction.

RSI is still pointing down, so EOS might follow suit while buyers take a break and allow sellers to take over. Stochastic is also moving down to indicate that sellers have control of the game for now. Once both indicators hit oversold levels and start turning up, buying pressure could return and allow the uptrend to resume.

Keep in mind that the referendum would mark a step forward for the EOS team in a democratic decision-making process. Although some are not happy with this route as a one-token, one-vote system would centralize the decision to people who have more tokens, the announcement has still generated an overall bullish reaction from the cryptocurrency.

Images courtesy of TradingView.