Dash recently made a strong rally on news of its partnership with Kripto Mobile Corporation (KRIP) in South America. This allows clients in the region to purchase Dash using a cryptocurrency-enabled mobile phone.

Note that demand for altcoins in the region has been particularly strong, owing to the fact that a number of countries are suffering hyperinflation and massive depreciation in local currencies. With that, citizens are looking for an alternative store of value or a better means of facilitating transactions, and Dash could meet those needs.

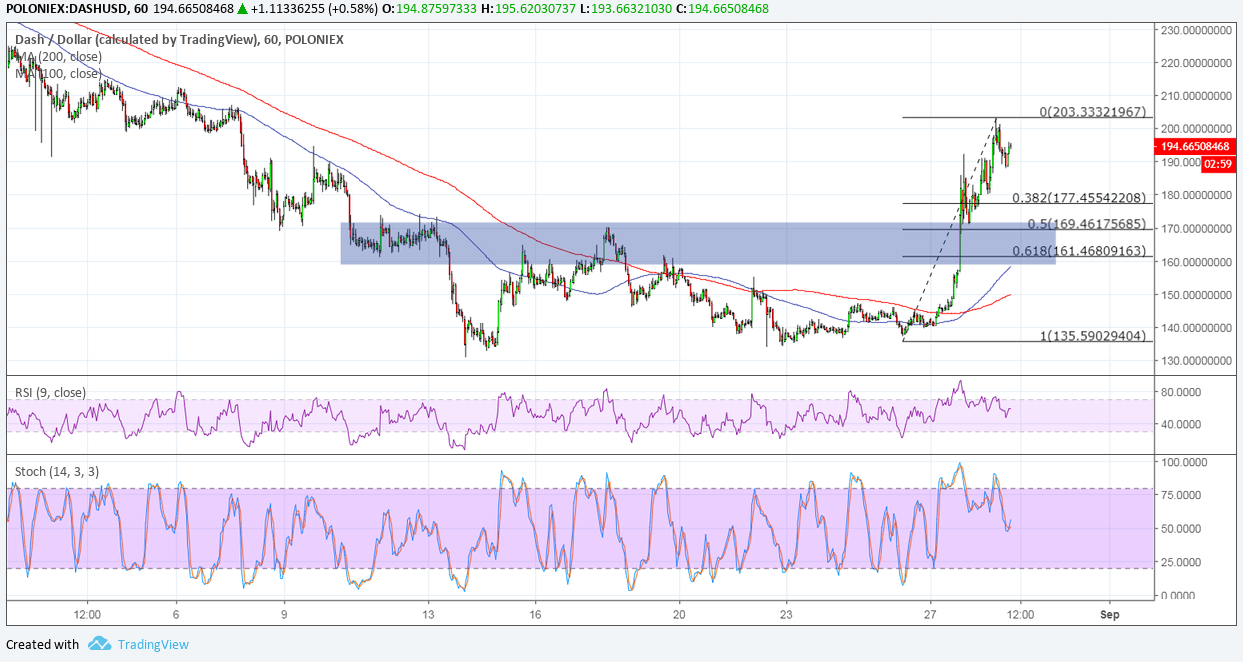

Price was previously consolidating in a descending triangle from around 130.00 to 160.00, so the resulting rally from the upside break could be of at least the same height. Dash also formed a double bottom pattern, which is a classic reversal signal, and has also broken past the neckline as confirmation.

However, price is also hitting resistance around the 200.00 major psychological mark, so a pullback may be due. Using the Fibonacci retracement tool on the latest swing low and high shows that the 61.8% level lines up with the former resistance around 160.00, which might now hold as support.

The 100 SMA just crossed above the longer-term 200 SMA to confirm that the path of least resistance is to the upside. In other words, there’s a stronger chance for buyers to gain traction from here. In addition, the 100 SMA dynamic support is close to the 61.8% Fib to add to its strength as a floor.

RSI is on the move down, however, indicating that selling pressure is present. Similarly, stochastic is heading lower so Dash might follow suit, especially since there’s plenty of room for the oscillator to slide before hitting oversold levels.

Once both RSI and stochastic do, buying pressure could return and allow Dash to retest the swing high and even break higher. Keep in mind that a survey in Venezuela revealed that people in the country see cryptocurrencies as a safe haven in an economy where the government has enforced strict foreign exchange controls since 2003.

Images courtesy of TradingView.