Bitcoin price continued surging last week to record its all time high of $1,909.37 last Thursday in Bitfinex, yet the market’s bulls failed to keep price at this level, as it dropped down to record the week’s low on Friday ($1,670), before rising again to $1796, as this article is being written.

So, where can bitcoin price be this week?

The Bulls Are Still In Control On the 1 Day BTCUSD Chart:

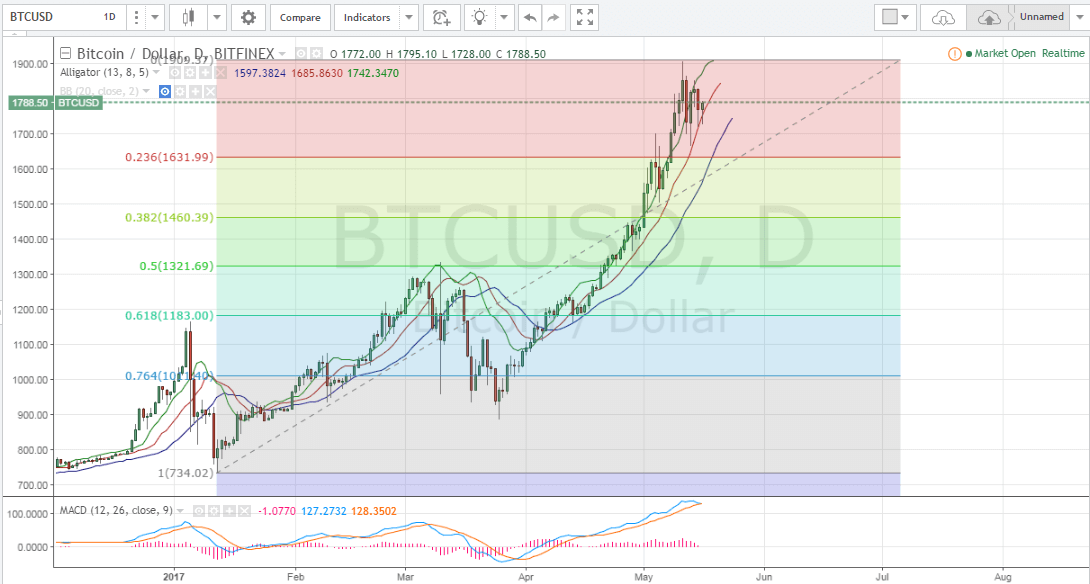

By examining the 1 day BTCUSD chart from Bitfinex, and plotting the Williams Alligator Indicator as well as the MACD indicator (look at the below chart), we can observe the following:

- To establish key resistance and support levels, we will plot a Fibonacci retracement that extends between the low recorded on the 12th of January ($734.02) and the high recorded on the 11th of May ($1909.37). The 23.6% Fib retracement level, which corresponds to the $1631.99 price level seems to be supporting price quite well, as shown by the relatively long downwards shadows of the candlesticks that represent trading sessions of the past few days. So, if downwards price correction attempts ensue again, they will most probably be reversed around $1,631 which represents a strong support level during this period.

- The Williams Alligator Indicator’s bullish signal is still present as the green SMA is above the red SMA and both of them are above the blue SMA. Accordingly, we are likely to see bitcoin price continue surging, after the current price correction attempts are over, especially that the MACD indicator also exhibits a bullish signal, as the positive (blue) trend line is above the negative (red) trend line and both of them are in the positive territory.

Moving Away from the 1 x 2 Gann Angle on the 4 Hour BTCUSD Chart:

Now, let’s take a look at the 4 hour BTCUSD chart from Bitfinex, while keeping the Fib retracements we plotted earlier and executing the Bollinger Bands indicator:

- We can plot Gann angle placements between the low recorded on the 25th of March ($887) and the all time high scored on the 11th of May ($1909.37). As shown on the below chart, price is moving now below the 1 x 2 Gann angle, which reflects current stabilization of the market, which was not the case a few days ago when candlesticks touched the 1 x 2 Gann angle. Chances are high, with this alignment of candlesticks around the Gann angles, to see price continue rising after completion of the downwards price correction attempts.

- Candlesticks are now moving along the middle Bollinger band, which also reflects a relatively stable market, so conditions are favorable to see bitcoin price continue rising towards the end of the week.

Conclusion:

Bitcoin price continued rising last week to record its all time high of $1909.37 on Bitfinex. Our technical analysis is in favor of continuation of this bullish wave, yet we can see price correction attempts take price down first to touch the 23.6% Fib retracement level, which corresponds to the $1631.99 price level.

Charts from Bitfinex, hosted on Tradingview.com