Just like we expected throughout our Friday’s price update, Bitcoin’s bullish wave was reversed as the market’s bears took the upper hand starting a downwards price correction wave that pulled price all the way down to a low of around $1810 on Bitfinex last Saturday. After recording the week’s low, bitcoin price started heading North to record a high of $2193 during Sunday’s trading sessions.

So, where will price be heading during the upcoming week? Will the downwards price correction wave continue on pulling price down to lower levels?

Strong Support Evident On the 4 Hour BTCUSD Chart:

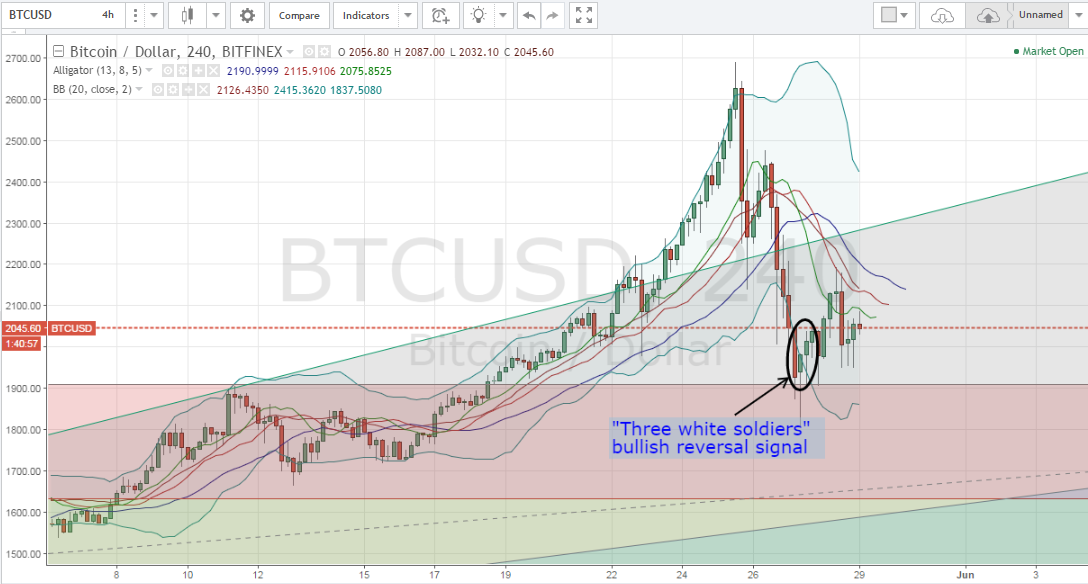

Let’s examine the 4 hour BTCUSD chart from Bitfinex, while keeping the Fibonacci retracements and Gann Angle placements we plotted during our latest BTC analysis and executing the Bollinger Bands and Williams Alligator indicators (look at the below chart), we can conclude the following:

- After recording an all time high of $2693, bitcoin May’s bullish wave was reversed on Thursday and price started dropping, as traders were closing their long positions to collect profits, all the way down to $1810. After hitting the week’s low, price started rising slowly to $2193, before falling down again to $2045 at the time of writing of this update.

- The downwards price correction wave was halted when price approached the support level around ($1909.37) which corresponds to the 100% level of the Fibonacci retracement we plotted during our previous analyses. Strong support around this level can be evidenced by the long downwards shadows of the candlesticks highlighted by the black ellipse on the above chart.

- A “three white soldiers” signal can be observed on the above chart (the four candlesticks highlighted by the black ellipse on the above chart). The signal consists of three long bullish candles that progressively close on higher levels on each subsequent trading session. This signal is significant as it follows a downtrend period and signals that bitcoin price will continue rising again as shown by an advancing buying pressure.

- The bearish wave was reversed when candlesticks started touching the lower Bollinger Band, after which trading pulled price upwards towards the level of the middle Bollinger Band, at which the market is more stable. The Williams Alligator indicator’s smoothed moving averages are still exhibiting a bearish signal, so it is highly recommended to refrain from opening new long positions until we can see the indicator’s smoothed moving averages exhibit a bullish signal.

Conclusion:

Bitcoin price resumed rising again, after the downwards price correction attempt was reversed after scoring a week’s low of $1810. Our technical analysis concludes that price will continue on rising as the downtrend has been reversed.

Chart from Bitfinex, hosted on Tradingview.com