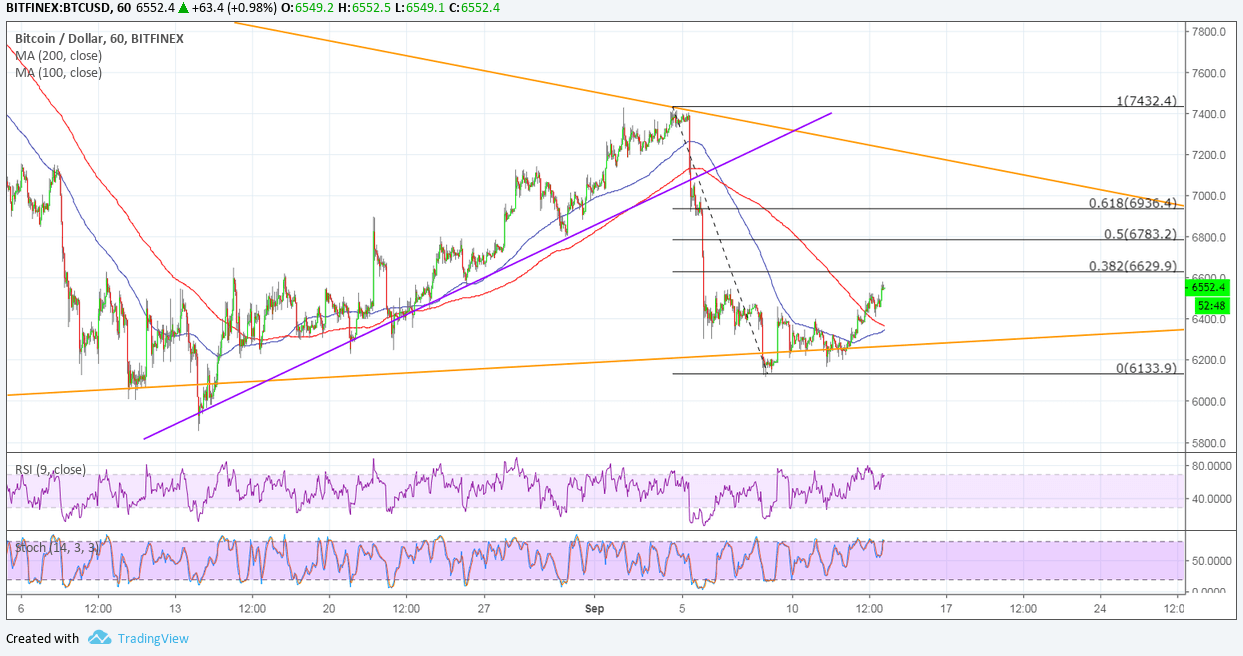

Bitcoin is still gaining some traction on its latest bounce off support and might be setting its sights on the upside targets marked in the chart below. Price is closing in on the first potential resistance at the 38.2% Fibonacci retracement level around $6,629.

Sustained bullish momentum past this level could take bitcoin up to the 50% Fib near $6,800 or the 61.8% Fib just below the $7,000 major psychological mark. From there, a test of the longer-term triangle top could be in the cards.

It’s also worth noting that bitcoin has recently slumped below a short-term rising trend line and that this could also serve as an extra upside barrier since it’s close to the top of the triangle. A break past all these levels could bring stronger bullish momentum and spur a longer-term rally.

RSI appears to be heading south after recently hitting overbought levels, so the Bitcoin price could follow suit. Stochastic also made its way down but appears to have changed its mind to suggest that buying pressure is returning.

Bitcoin appears to be finding support from reports indicating that Morgan Stanley is ready to offer Bitcoin swaps to its clients. This could renew the focus on institutional interest, one that appears to have waned when it was rumored that Goldman Sachs is ditching its plans to create a bitcoin trading desk.

Cryptocurrencies have been under pressure for the most part of the week owing to the SEC decision to temporarily halt trading in Bitcoin Tracker One and Ethereum Tracker One instruments, citing confusion among market participants on the nature of the underlying securities. Many worry that the regulator could cite similar reasons for possibly rejecting remaining bitcoin ETF applications, once again dampening sentiment in the industry.

Images courtesy of TradingView