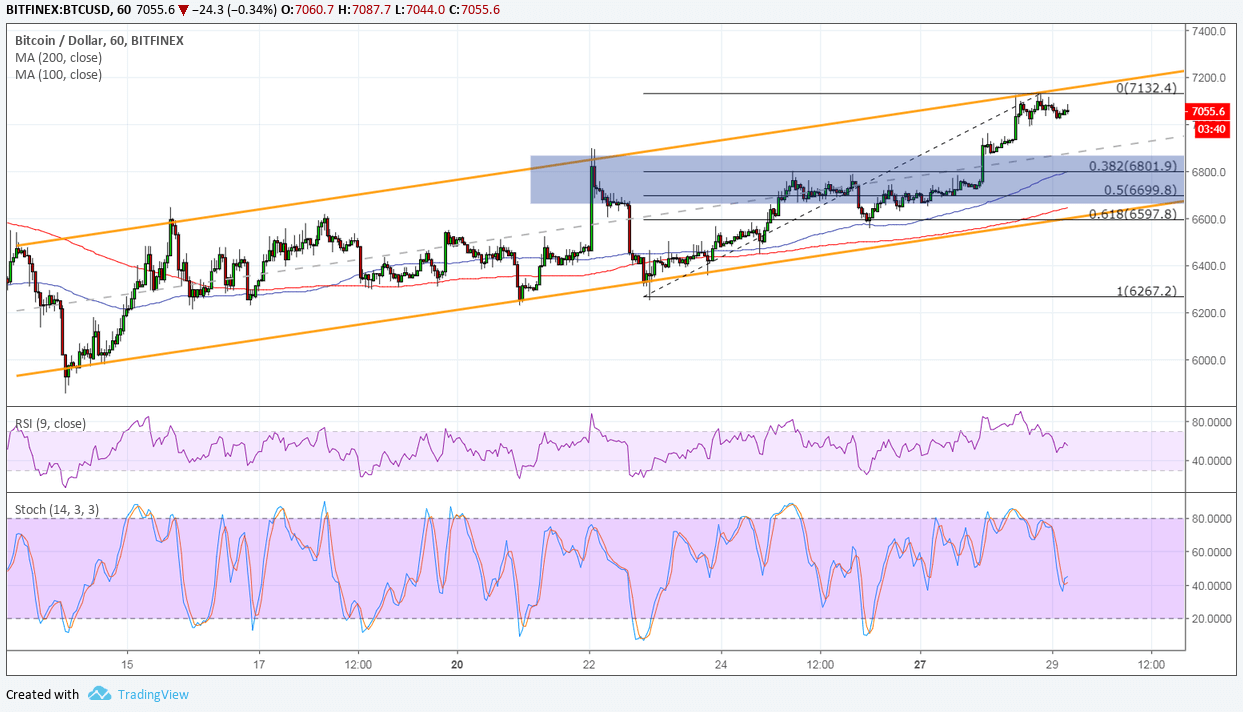

Bitcoin continues to climb inside its ascending channel visible on short-term time frames, indicating that bulls are slowly gaining traction. However, Bitcoin price is hitting the top of the channel and might need to pull back from its rally to gain more buying energy.

Using the Fibonacci retracement tool on the latest swing low and high shows that the 50% level lines up with the channel support around $6,700. Buyers might be waiting to hop in at better prices around this area, which also happens to be an area of interest or former resistance.

The 100 SMA is above the longer-term 200 SMA on this time frame to confirm that the path of least resistance is to the upside. This means that the uptrend is still likely to resume from here. The gap between the indicators is even widening to signal strengthening bullish momentum, with the 100 SMA lining up with the 38.2% Fib and the 200 SMA just above the 61.8% Fib.

RSI is on the move down, though, which means that sellers have the upper hand for now. Similarly, stochastic is heading south so Bitcoin price could follow suit. Both oscillators have room to head lower, so bears could stay in control for much longer until oversold conditions are seen. Once both oscillators turn back up, buying pressure could return and allow the uptrend to resume.

Sentiment is a bit more positive in the cryptocurrency industry thanks to several developments, even outside of Bitcoin. As for this particular digital asset, traders are still anticipating the decision of the SEC on pending Bitcoin ETF applications and approval could allow the much-anticipated rebound for the year to ensue.

Note that the SEC decided to review their earlier decision to reject a few applications while conducting their comment period for a few more weeks until the end of September. Any indication that an approval is in the cards could keep propping Bitcoin up in the weeks ahead.

Images courtesy of TradingView.