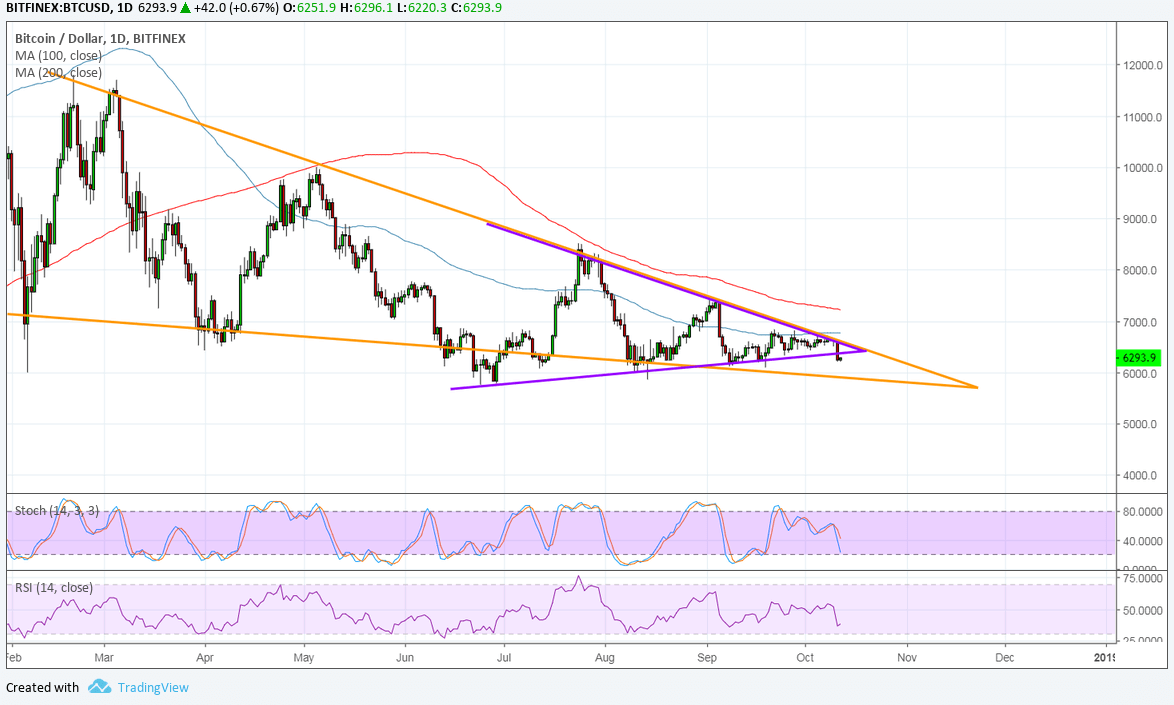

Bitcoin also broke below its longer-term triangle consolidation pattern seen on the daily time frame, setting its sights on the next support zones. The price might be ready to test the $5,800 area from here or the bottom of its falling wedge formation.

The 100 SMA is below the 200 SMA to confirm that the path of least resistance is to the downside or that the selloff is more likely to resume than to reverse. However, the gap between the moving averages is narrowing to reflect slowing selling pressure.

The freshly broken triangle spans around $5,800 to $8,000 so the resulting drop could be of the same height, enough to take Bitcoin below the wedge support. If that happens, an even steeper slide could ensue, possibly lasting by the same size as the wedge.

Stochastic is heading lower and has enough room to move south before reaching oversold levels to reflect bearish exhaustion. RSI also has a lot of room to cover before reaching oversold territory so bitcoin could see more losses until then.

Risk aversion has been present in financial markets over the past few days, weighing on demand for riskier assets like stocks and commodities. While cryptocurrencies have previously been able to take advantage of these situations, regulatory updates in the industry have kept Bitcoin and its peers on shaky ground.

For one, the anxiety leading up to Roubini’s testimony in Congress on its hearing on digital assets and blockchain has already led to easing on positions, and it doesn’t help that the low liquidity has paved the way for more volatile moves. This follows an earlier warning from the IMF on cybersecurity risks related to cryptocurrencies, as well as the FSB’s highlighting of crypto-assets’ weaknesses that prevent these from being a reliable store of value or replacement to fiat currencies.

Images courtesy of TradingView