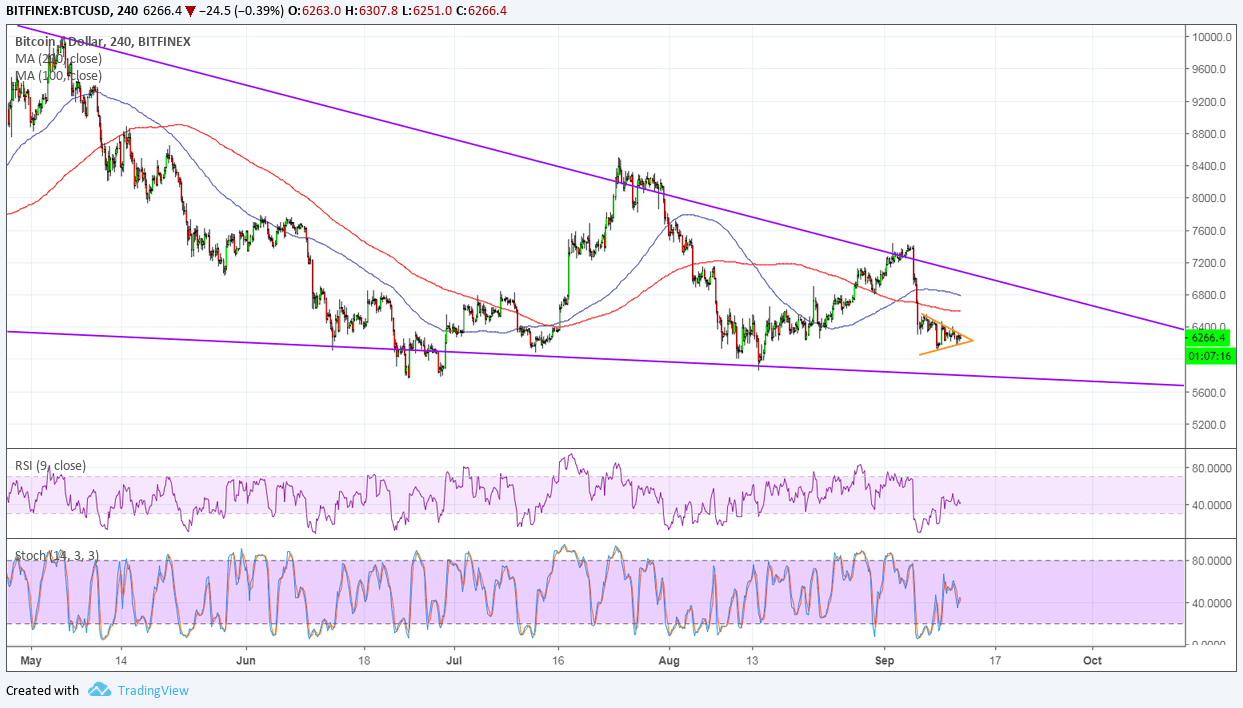

Bitcoin still seems to be stuck in consolidation for now in what appears to be a bearish flag formation after the recent slide. In that case, this could be a continuation signal, and confirmation will take bitcoin to the next support area.

This could be around the $5,800 to $6,000 zone which bulls have strongly defended in the past. A larger drop could lead to the bottom of its falling wedge pattern visible on the 4-hour time frame.

However, the 100 SMA is above the longer-term 200 SMA to confirm that the path of least resistance is to the upside. In other words, an upside break is more likely to happen than a move lower. If so, bitcoin could revisit the top of the wedge around the $6,800 level or test the nearby inflection points at the moving averages.

RSI appears to be on the move up to indicate that buyers are in control of price action. Stochastic is also heading higher but could be changing its mind halfway through and signaling a return in bearish pressure.

Bitcoin has been off to a poor start for the week and many blame the SEC announcement on suspending trading in a couple of crypto-based securities, dampening hopes that the regulator could approve the bitcoin ETF applications awaiting their ruling later this month.

This also derails expectations for a strong rebound in the remaining months, possibly even leading to more losses for bitcoin instead. Keep in mind that selling pressure tends to pick up on breaks of technical levels, although the cryptocurrency appears to be finding some support from its rising market dominance these days.

As of this writing, Bitcoin is closing in on 60% of the market share versus its altcoin rivals. Its dominance has now reached 56.9%for the first time since December 16 last year, which was then followed by the sharp rally.

Images courtesy of TradingView