Bitcoin daily transaction recently reached its highest level since the middle of January 2018. The top-ranked cryptocurrency based on market capitalization continues to go through a bear market with prolonged periods of sideways trading.

Daily Bitcoin Transactions on the Rise

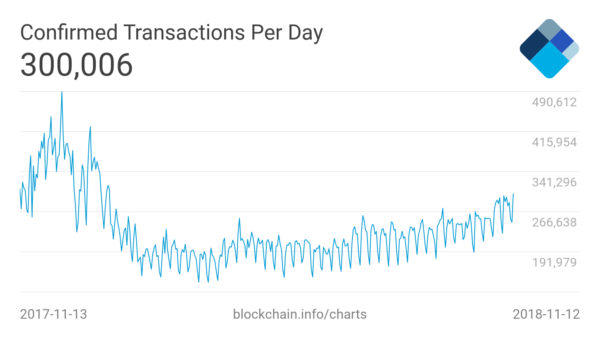

According to Blockchain, current Bitcoin average daily transaction stands at a little over 300,000. This figure represents a ten-month high and a continuous increase over the last seven months.

After peaking at close to 500,000 transactions per day during the December 2017 bull run, the onset of the bear market brought levels down to 135,000 in April 2018. Since then, however, daily transactions continue to increase, going up more than double to reach its present level.

For comparison, the present Bitcoin daily transaction level is only about 9,000 lower than the value recorded 12 months ago. If the trend set in the past is anything to go by, then further increase could be on the cards.

Transaction Fees Remain Low

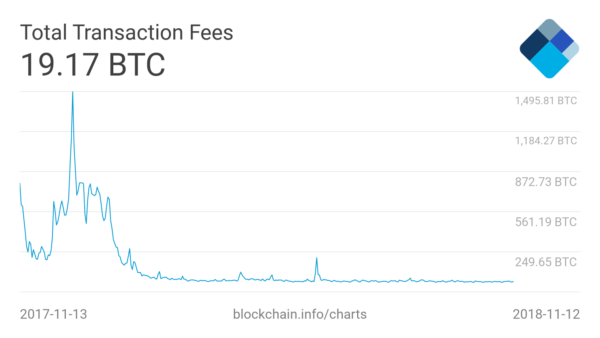

Despite the steady increase in the daily transaction, fees remain relatively low. Also, data from Blockchain shows that the cost per transaction continues to decline. Presently, the cost per transaction stands at $36 – its lowest level in the last 12 months.

Much of this has to do with the emergence of SegWit and off-chain protocols like Lightning. During the peak daily transaction levels of 2017, fees rose as high as $50 with many calling the question the ability of the network ever to support largescale transaction volumes.

However, with the introduction of protocols like SegWit and the Lightning network, a surge in transaction volume hasn’t led to a corresponding increase in fees.

Bitcoin Bear Market Continues

Bitcoin continues to experience the bear market conditions that have dominated 2018. Since briefly rallying to $7,300 at the start of September, the top-ranked cryptocurrency has remained firmly stuck below $6,500.

With prolonged tight range-bound trading, BTC’s volatility dropped to its lowest level since 2016. Commentators like Arthur Hayes, the BitMEX CEO, say that the current bear market will persist for the next 12 to 18 months.

The extended sideways trading has seen some observes sticking to their bullish predictions while others offer significantly less optimistic forecasts. Presently, BTC is down by about 0.7 percent in the last 24-hours.

Do you think the rise in daily transactions is a precursor to a significant Bitcoin price rally? Let us know your thoughts in the comment section below.

Image courtesy of Blockchain.