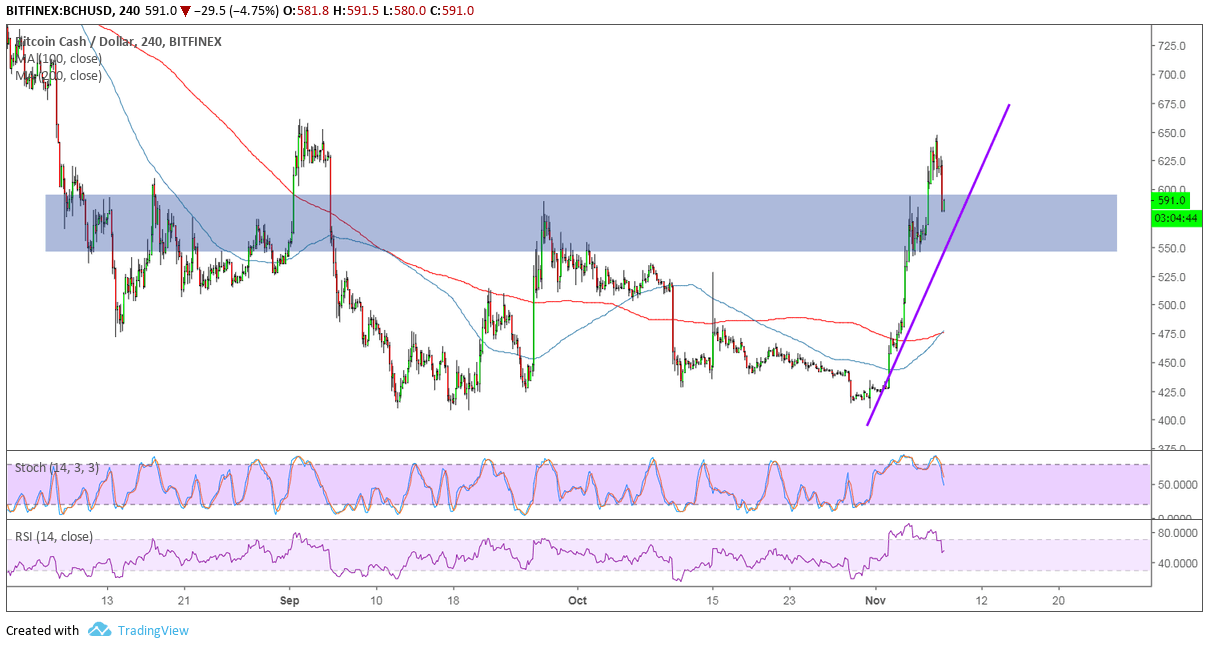

Bitcoin Cash recently busted through a near-term area of interest around $550-600, signaling that bulls are gaining control of price action. This also happens to be the neckline of a double bottom classic reversal chart pattern.

However, the price seems to be hesitating at yet another resistance area around $650, leading to some profit-taking and a pullback. A steep rising trend line can be drawn to connect the latest lows and this might serve as support since it lines up with the area of interest.

The 100 SMA is just attempting to cross above the longer-term 200 SMA to confirm that bullish pressure is returning. Then again, this might be indicative of range-bound action as the moving averages had previously been oscillating.

Besides, Stochastic is just making its way down after reaching overbought territory, indicating that a return in selling pressure is just getting started. RSI has also turned south and has plenty of room to cover before hitting overdone levels, which means that bears could stay in control for much longer.

Bitcoin Cash has been climbing but is on shaky footing leading up to its hard fork. A number of exchanges are already making preparations for this move, which typically leads to a dip in liquidity while trading is temporarily halted.

Still, there’s a lot to look forward to as Poloniex announced that it will be the first exchange to offer trading for the BCH hard fork:

We’re doing this to empower customers to demonstrate their support for one coin over the other through trading activity. Poloniex will also support trading markets for both tokens after the hard fork.

Also, six out of the ten major exchanges that support Bitcoin Cash already expressed intentions to support its upcoming hard fork on November 15. This includes OKEx, Binance, Bitforex, and Huobi.

Images courtesy of TradingView