Platform Name: World Markets

Website: https://worldmarkets.com/

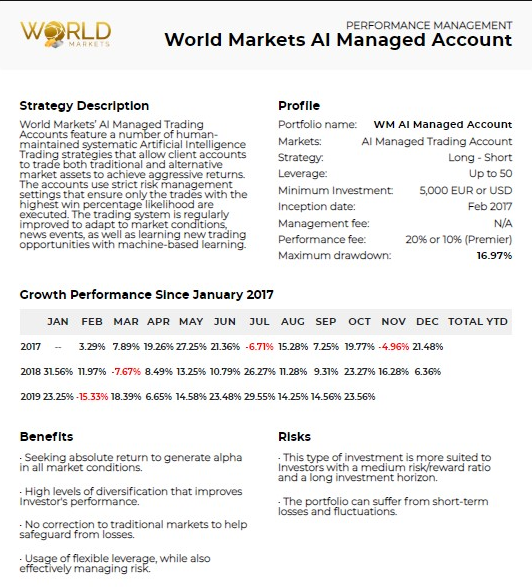

Minimum Investment: USD/EUR 5000

Leverage: Up to 50x

Offices: Norway, China, Iceland, Switzerland, Bahrain, Panama

Bullion Vaults: Zurich, London, Singapore, Toronto, Hong Kong

Partnerships: BarChart, TradingView, BitMEX, BullionVault, BullionByPost, HY Markets, DX.Exchange, National Bullion House

Trading Instruments: AI Managed Accounts, Gold & Silver Bullion, Exotic Metals, Digital Gold, STOs and more.

Awards:

Best Bullion Exchange of the Year 2019 – Global Brands Magazine

Best AI Company of the Year 2019 -Global Brands Magazine

Best Managed Account 2019 – The 22nd China (Guangzhou) International Investments & Finance Expo

Best AI Company 2019 – The 22nd China (Guangzhou) International Investments & Finance Expo

The Best Trading Performance 2019 – World Forex Award

Best Gold Dealer 2018

Best Managed Account 2018

Overview

World Markets is a popular feature-rich platform that has been around for a while. What started as a precious metal dealer back in 2003, has now grown to become one of the top Trader-Operated Artificial Intelligence Managed trading platforms. The platform has a strong userbase with over 50,000 clients from across the world and an average retail account size of 25,000. World Markets is currently managing clients’ assets worth over $30 million, delivering YTD compounded annualized returns of around 211%.

With its state-of-the-art crypto-supported platform, World Markets has managed to offer its investors better returns even in the midst of a bear market at an average monthly performance rate of 21.67%.

Features

There are plenty of trading platforms out there, but World Markets stands apart from the rest due to its expertise and some of the most technologically advanced features it implements. The most important feature of World Markets is the “Trader-Operated Artificial Intelligence Managed” trading accounts. These are accounts where the users’ funds are managed by expert analysts and traders from World Markets with the support of advanced artificial intelligence which analyses the market trends etc., to create relevant trading strategies that can be profitable. The platform strives to strike a perfect balance between artificial intelligence and human involvement to get the most out of the markets. According to the World Markets website, all the trades are executed by humans, and the AI is confined to analyzing and predicting the markets and coming up with the right trading strategies. These strategies are further analyzed by experienced traders and human analysts and implemented. With such a setup, World Markets has been able to constantly ensure positive returns on investment for the users irrespective of the market conditions. As a part of its initiative to further improve the AI-supported trading feature, World Markets has invested in the development of advanced supercomputing systems capable of monitoring global markets to generate prediction models and trading strategies.

Apart from Managed Trading Accounts, World Markets also supports trading in Bullion, Digital Gold, Exotic Metals, Security Token Offerings (STOs), etc. either through its own infrastructure or partnerships with top trading platforms. The platform’s offerings are designed to cater to the diverse trading needs of both institutional as well as retail investors, which makes it the most versatile asset management and trading solution provider currently in the market.

The platform also has a dedicated section for education and training materials that allows users to gain an understanding of the markets, various available trading instruments and learn how to trade them. These educational resources are a good starting point to those who are new to trading and when combined with the Managed Trading Accounts, they can start reaping profits on par with experienced traders.

Accounts, Fees and Payment

World Markets offers three different types of accounts to its users. The first one is a trial account that starts with a minimum deposit of $2500 and valid for 30 days after which it has to be converted to any one of the other two account types. The second type is the standard account with a minimum deposit of $5000 which offers users full access to AI trading on all instruments. And finally, the third type is the Gold Premier Account at a minimum deposit of $25,000 which comes with all the benefits associated with the standard account, along with additional discounts and an ability to test beta systems before rest of the userbase. The Gold Premier Account holders also get a dedicated regional account manager.

When it comes to the fees, World Markets probably has the lowest asset management fee structure at 1% as Annual Management fees. In addition, users are charged 20% and 10% Performance Fees for Standard and Gold Premier Accounts respectively.

The platform supports multiple deposit and withdrawal options including the conventional wire transfer, leading credit cards like Visa and MasterCard, Skrill, WebMoney, Bitcoin and Ethereum. Almost all transfers in and out of the platform are free except for credit card payments. Further, based on whether the user has a Standard or a Gold Premier Account, they can initiate 6 or 12 withdrawals respectively.

Security

Security of users’ information, accounts and stored funds get the highest priority on the World Markets platform. It employs military-grade encryption combined with state-of-the-art security features and 2FA authentication to secure accounts and funds associated with them. In addition, the platform also implements safe trading practices and best in class trading software as a measure to minimize losses on trades. The software is further supported by advanced risk management protocols that provide information to the World Markets’ trading team, helping them in executing each trade.

World Markets also has collaborations with few Tier-1 liquidity providers and banking institutions who act as custodians of funds.

Users are always in control of their funds on World Markets, and they can choose to invest further or withdraw at any time. The MQL Copy Trader Dashboard ensures transparency of all the trades executed on behalf of the investors, and the information can be accessed in real-time 24/7.

Customer Support

World Markets has a robust customer support infrastructure in place to cater to the truly global userbase. The platform has set up multiple phone lines (37 lines) dedicated to answering customers from various geographies. In addition, traders can also send an email to tradingdesk@worldmarkets.com or fill the form on the website to reach out to the platform’s customer executives, assured that their emails will be answered within an hour or two at the maximum.

Affiliate Program

World Markets has an attractive Affiliate Program where existing customers can refer new users. With each successful referral, the person referring will receive a 50% share of all the fees collected from the new user. In addition, if a user manages to successfully refer 10 people or more to create an account and start trading on World Markets, they stand to receive a 1 oz Credit Suisse Gold Bar for every 10 accounts.

Conclusion

World Markets has the best trading and security infrastructure with an attractive fee structure that makes it ideal for all kinds of investors provided they are willing to make a bit higher upfront investment ($5000) than on other platforms in the market. However, given the historic return on investments, made possible by a combination of Artificial Intelligence and Expert Fund Managers makes this initial cost worthwhile.