Gemini is leaving Canada without explanation. Many believe it is because of the country’s tough stablecoin approach.

The popular crypto exchange co-founded by the well-known Winklevoss twins, Gemini, has let its Canadian users know it will exit the country at the turn of the calendar this year. While it did not state why in the emails it sent the users, many speculate it is because of Canada’s strict oversight of the crypto ecosystem.

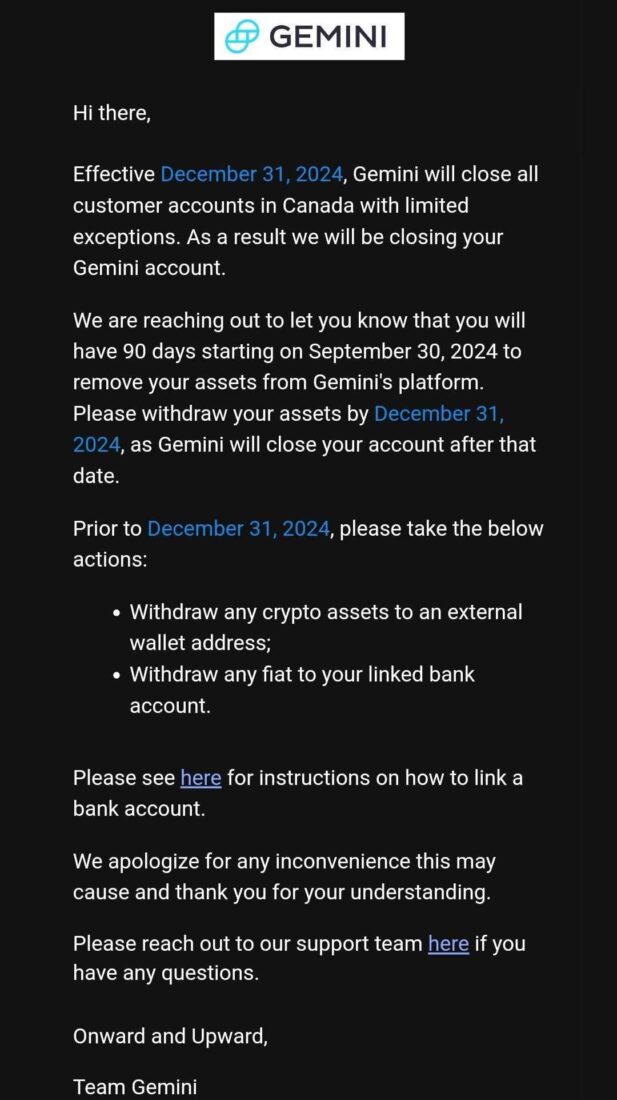

“Effective December 31, 2024, Gemini will close all customer accounts in Canada with limited exceptions,” the email read. It added that users have “90 days starting on September 30, 2024,” to withdraw assets and fiat from their Gemini accounts.

Email sent to Gemini’s Canadian users.

On September 26, the Canadian Securities Administrators (CSA) announced that it would extend its deadline for crypto trading platforms (CTPs) to comply with its stablecoin regulations to December 31. The deadline before this extension was October 31. It was previously extended to that date from April 30.

“The extension is intended to provide more time for CTPs to either comply with the terms and conditions of their registration and exemptive relief decisions, or their PRUs [pre-registration undertaking], or to propose alternatives that address investor protection concerns, as long as any alternatives are in place or substantially finalized prior to December 31, 2024,” the CSA’s September 26 release read.

Canada’s Stringent Stablecoin Regulations Are Not Favored by Service Providers

The CSA banned algorithmic stablecoins in December 2023 to only allow fiat-backed crypto assets (FBCAs), like fiat-backed stablecoins, offered by those upholding transparency and relying on legitimate custodians.

“For clarity, CTPs are also reminded that they were required to no longer allow clients to buy, deposit or enter into crypto contracts to buy or deposit VRCAs [virtually referenced crypto assets] other than certain FBCAs by December 29, 2023,” the recent CSA release mentioned. Unauthorized exchanges were ordered to stop dealing with FBCAs by April 2024.

Since exchanges deal massively with stablecoins—for instance, offering asset trading pairs with stablecoins—many have found Canada’s approach more strict than needed. Numerous firms like OKX, dYdX, and Bybit stepped out of the market in 2023.

Gemini, before its recent exit, had filed for a PRU and to become a restricted dealer. Others that have filed for PRUs include ByteX, Crypto.com, DigiFinex, Gemini, Kraken, NDAX, Satstreet, and Uphold. Fully authorized exchanges include Coinbase Canada, Coinberry, Fidelity Clearing Canada, Netcoins, and several more. Canada has also banned multiple exchanges, like CoinEx, XT.COM, LiquiTrade, Poloniex, KuCoin, and Catalyx.