FTX’s native FTT token dipped by 70% as social media accounts with large followings spread misinformation about the exchange commencing its repayment process.

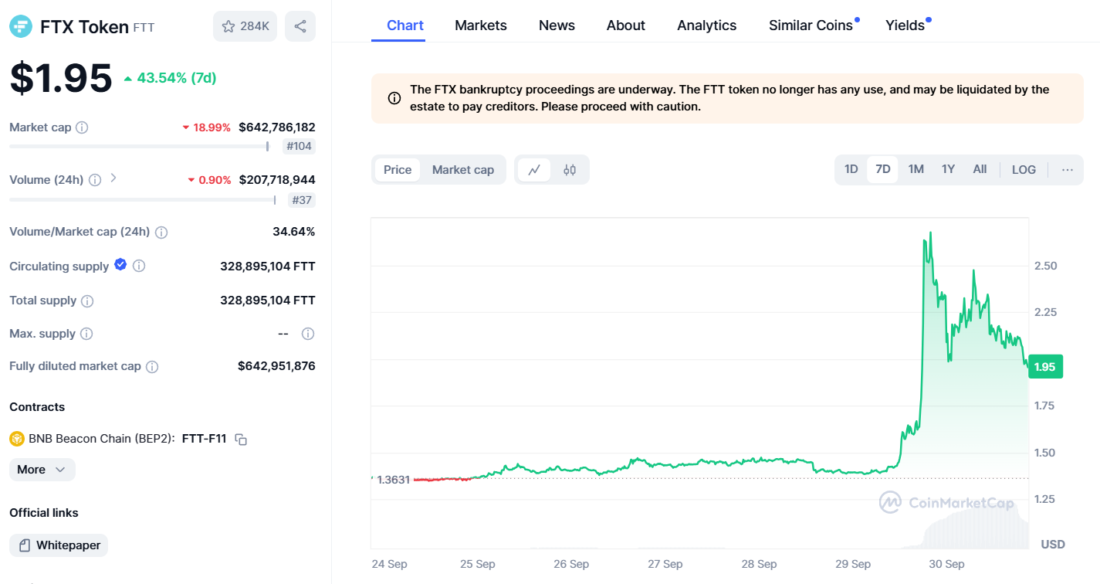

The defunct FTX exchange’s native FTT token showed signs of life briefly on September 29 as its price rose by 70% to $2.71. FTT broke out into its short-lived rally as rumors about FTX’s much-awaited reimbursements to creditors circulated on social media.

Source: CoinMarketCap

However, an exact date for the start of the repayment has yet to be decided. A filing shows that the court has not approved FTX’s repayment process yet and will take steps to do so during a hearing scheduled for October 7.

It looks like the clarifications shutting down the reimbursement rumors are sending FTT’s prices down, as the asset fell below $2 on September 30, the time of writing. The token traded below $1.4 before pulling its 70% rise yesterday and looks to be heading back to that valuation.

Crypto circles on X took shots at “large accounts” for “farming clout with false news that FTX starts distributing.” The FTX reimbursement process is more complicated than most expect. Users owed less than $50,000 will likely receive their funds by this year’s end. Those owed more than that will likely receive their funds in the first two quarters of 2025. Sunil Kavuri, leading the FTX repayment process, confirmed that, as he mentioned the entire recovery process could span the next two to three years.

Source: Ed_NL on X

Many Are Challenging FTX’s Repayment Process

With the reimbursements looming closer, FTX creditors and Kavuri are opposing how it is playing out. While FTX’s bankruptcy estate is adamant about conducting the repayments in cash to not affect the process, creditors want to receive their funds in crypto. Receiving cash will engender taxation, which creditors do not want to deal with.

While one of the proposals mentioned retrieving the funds via stablecoins, the US Securities and Exchange Commission (SEC) warned that it would step in to question the legality of the approach. It did not explicitly call the method unlawful, just that it would challenge it if taken.

The FTX repayment process has also witnessed other hurdles, including a US Trustee, Andrew Vara, challenging the legal immunity provided to FTX’s administrators and advisors. He also called out the skew with which the repayments would occur—those owed below $50,000 will receive 119% of their funds, while those owed above that will receive 143%.