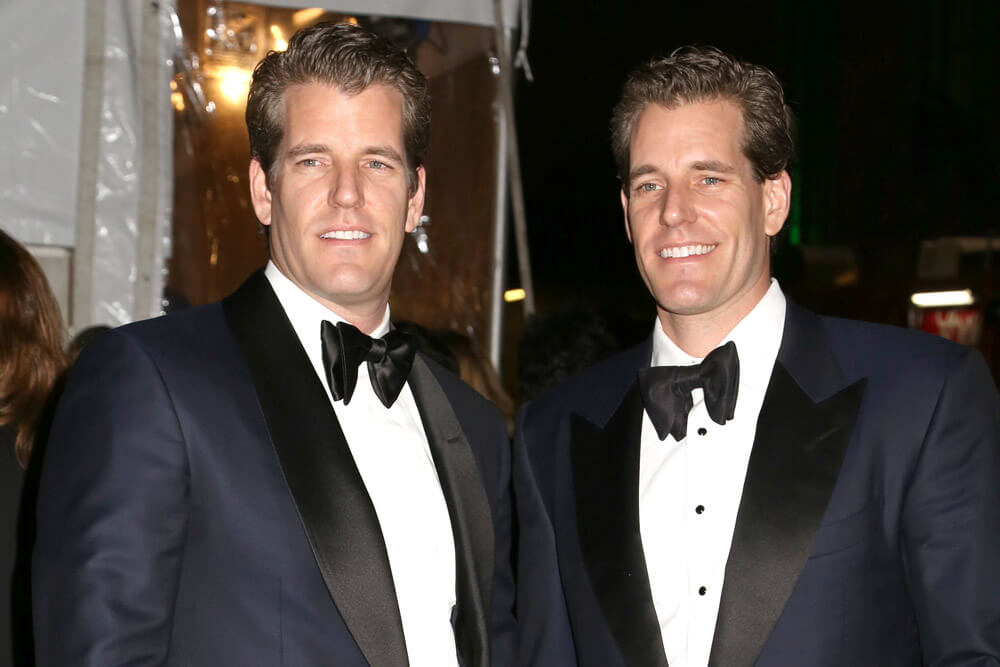

The Winklevoss Twins – the head executives of the Gemini Exchange in New York – believe that the price of bitcoin could potentially reach $500K in the coming future.

The Winklevoss Twins Are Pushing BTC All Over Again

While they didn’t give a date regarding when people can expect the world’s number one cryptocurrency by market cap to reach this figure, they did say that with the current state of the dollar and with gold on such a meteoric rise in recent weeks, bitcoin is looking better than ever, and that it’s price could potentially hit a mark nobody could have predicted.

They commented that the main thing that’s pushing BTC right now is its newfound reputation as a potential tool to hedge one’s wealth. Right now, economies across the globe are suffering greatly, and bitcoin, gold and similar assets are being looked at as products that protect one’s income and overall wealth from the problems that economies like this tend to bring, inflation being a huge one.

In a recent blog post, the Winklevoss Twins write:

Gold and oil have historically been reliable stores of value. Because they are scarce commodities, they make dependable hedges to the inflation of fiat currencies. As a result, they have commanded price premiums above and beyond the demand for their consumption alone… With that said, we believe there are fundamental problems with gold, oil, and the U.S. dollar as stores of value going forward.

They explain that one of the big problems with relying too much on the dollar is that it is far too vulnerable to market surprises, COVID-19 being a big example. As nobody was able to predict the rise of the pandemic, the national fiat currency of the United States has had to react primarily to the financial woes that the economy has had to endure, and as a result, it has suffered greatly.

In addition, the way traditional banks operate have ultimately run their course and cannot satisfy the many customers in need of financial services and products. The Twins argue:

Money stored in a bank will get run over. Money invested in assets like real estate or the stock market will keep pace. Money stored in gold or bitcoin will outrun the scourge.

Similarities with Gold?

The Twins also discussed that bitcoin is showing similar behavioral patterns to gold, and suggest:

If we are right about using a gold framework to value bitcoin, and bitcoin continues with this path, then the bull case scenario for bitcoin is that it is undervalued by a multiple of 45. Said differently, the price of bitcoin could appreciate 45 times from where it is today, which means we could see a price of $500,000 per bitcoin… Bitcoin will continue to cannibalize gold and this story will play out dramatically over the next decade.