- Ethereum price declined heavily and broke the $168 and $160 supports against the US Dollar.

- ETH tested the $145-146 support area and it is currently correcting higher.

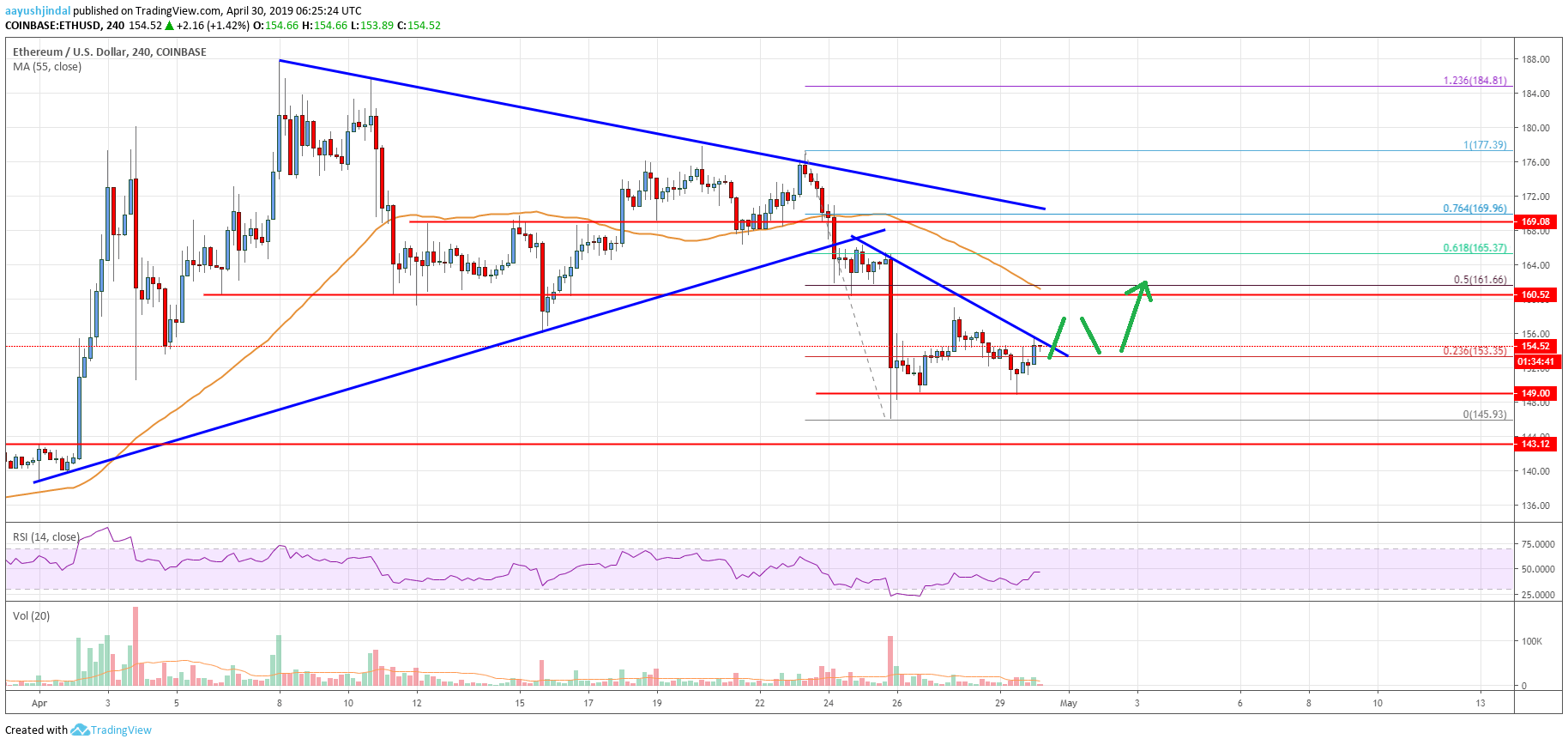

- There is a short term bearish trend line forming with resistance at $155 on the 4-hours chart (data feed from Coinbase).

- The price could recover towards the $160 and $165 levels if there is a close above $155.

Ethereum price started an upside correction after a strong decline against the US Dollar. ETH is likely to rebound in the near term towards the $160 and $165 resistance levels.

Ethereum Price Analysis

This past week, there was a strong decline in Ethereum price from the $177 swing high against the US Dollar. The ETH/USD pair broke many supports near $168 and $160 levels to enter a bearish zone. There was even a close below the $160 level and 55 simple moving average (4-hours). Besides, the price broke a major connecting bullish trend line with support at $165. Finally, there was a break below the $152 support level before the bulls appeared near the $145-146 zone.

A swing low was formed near $146 and the price is currently correcting higher. It moved above the 23.6% Fib retracement level of the last drop from the $177 high to $146 low. However, the price is facing hurdles near $155 and $156. There is also a short term bearish trend line forming with resistance at $155 on the 4-hours chart. If there is an upside break above the $155 and $156 levels, the price could test the $160 or $161 levels. The $161 level is a strong resistance since it is close to the 50% Fib retracement level of the last drop from the $177 high to $146 low.

Above $161, the price could recover towards the $165 resistance level. More importantly, if there is a proper close above $161 and the 55 simple moving average (4-hours), the price could move into a positive zone. If not, the price may resume its downward move. An initial support is at $150, below which the price may retest the $145-146 support area.

Looking at the chart, Ethereum price is showing signs of an upside correction above $155. If the bulls fail to gain strength, there is a risk of another push below $150. In the mentioned case, the price is likely to break $145 and trade to a new monthly low.

Technical indicators

4 hours MACD – The MACD for ETH/USD is slowly moving back in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for ETH/USD recovered recently and it is near the 50 level.

Key Support Levels – $150, followed by the $145 zone.

Key Resistance Levels – $156 and $161.