- Bitcoin price surged above the $4,800 and $5,000 resistances this past week against the US Dollar.

- The price tested the $5,350 level and later started a downside correction.

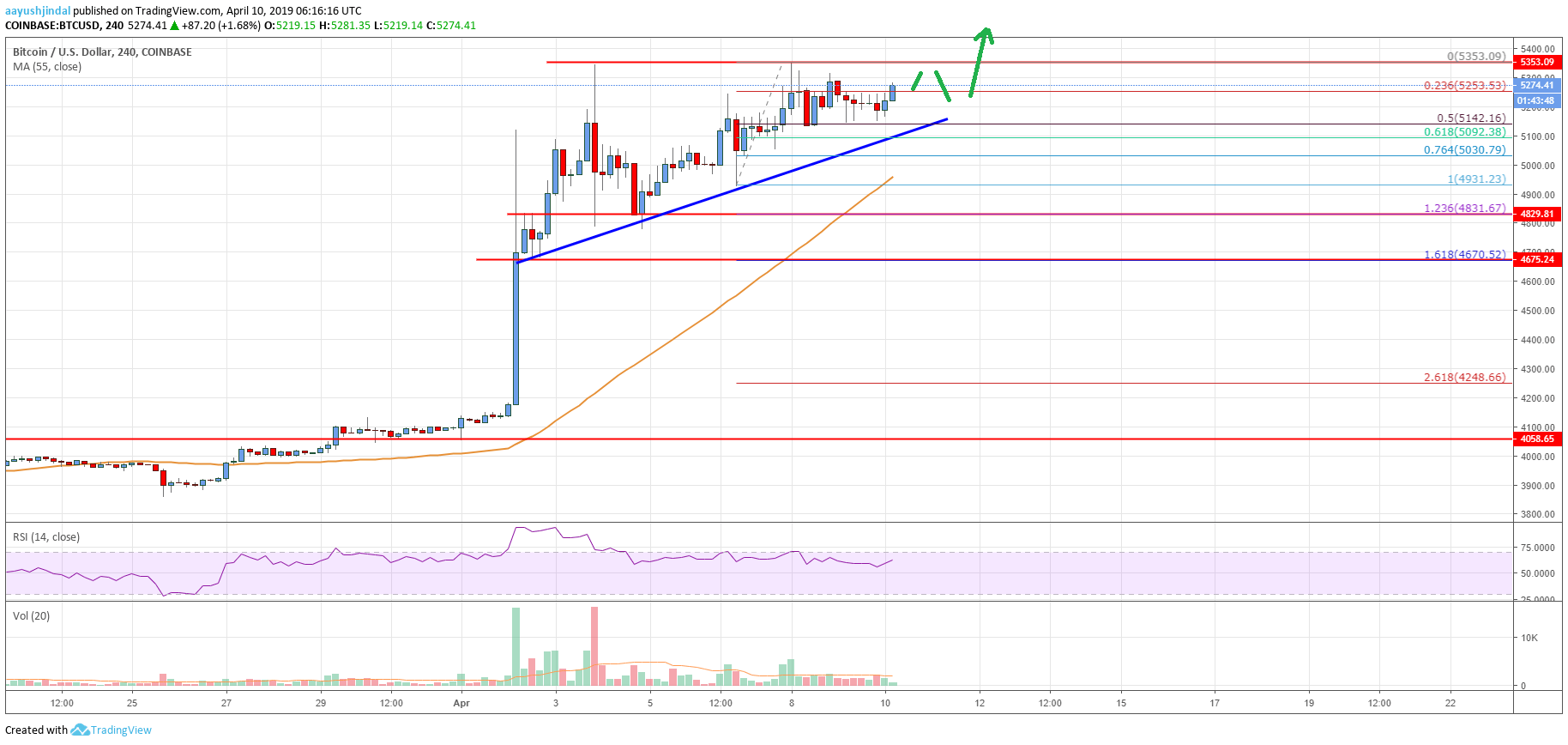

- There is a major bullish trend line in place with support at $5,140 on the 4-hours chart of the BTC/USD pair (data feed from Coinbase).

- The pair seems to be preparing for more gains above the $5,350 and $5,400 levels in the near term.

Bitcoin price jumped into a bullish trend above the $5,000 level against the US Dollar. BTC is gaining bullish momentum and it may continue to rise above $5,400 in the coming days.

Bitcoin Price Analysis

This past week, there was a strong rise in bitcoin price above the $4,800 and $5,000 resistance levels against the US Dollar. The BTC/USD pair even broke the $5,200 level and settled well above the 55 simple moving average (4-hours). The price traded towards the $5,350 level and a new 2019 high was formed at $5,353. Later, there was a downside correction below the $5,200 and $5,000 levels. However, the previous resistance near $4,800 level acted as a solid support. The price bounced and traded towards the $5,350 level before a fresh downside correction.

It recently corrected below the $5,260 level and the 23.6% Fib retracement level of the recent wave from the $4,931 low to $5,353 high. However, the $5,160 level acted as a strong support. The price also stayed above the 50% Fib retracement level of the recent wave from the $4,931 low to $5,353 high. There is also a major bullish trend line in place with support at $5,140 on the 4-hours chart of the BTC/USD pair.

The pair is currently trading nicely above the $5,160 and $5,200 levels, with a positive angle. It seems like the price may revisit the $5,350 resistance area. If there is a successful upside break above $5,350, the price might accelerate towards the $5,400 resistance level. Any further upsides is likely to push the price towards the $5,500 and $5,550 levels.

Looking at the chart, bitcoin price is clearly trading in a solid bullish trend above $5,140 and $5,080. On the upside, a break above the $5,350 resistance may open the doors for further gains. Bulls are likely to target the $5,500 level in the coming days. Conversely, a break below the trend line support might trigger an extended decline towards the $4,830 support.

Technical indicators

4 hour MACD – The MACD is gaining momentum in the bullish zone.

4 hour RSI (Relative Strength Index) – The RSI is placed nicely above the 55 level, with a positive angle.

Key Support Levels – $5,140 and $5,080.

Key Resistance Levels – $5,350, $5,400 and $5,500.