- Bitcoin cash price gained traction recently and broke the $164 resistance area against the US Dollar.

- The price traded to a new monthly high at $172.8 before correcting lower.

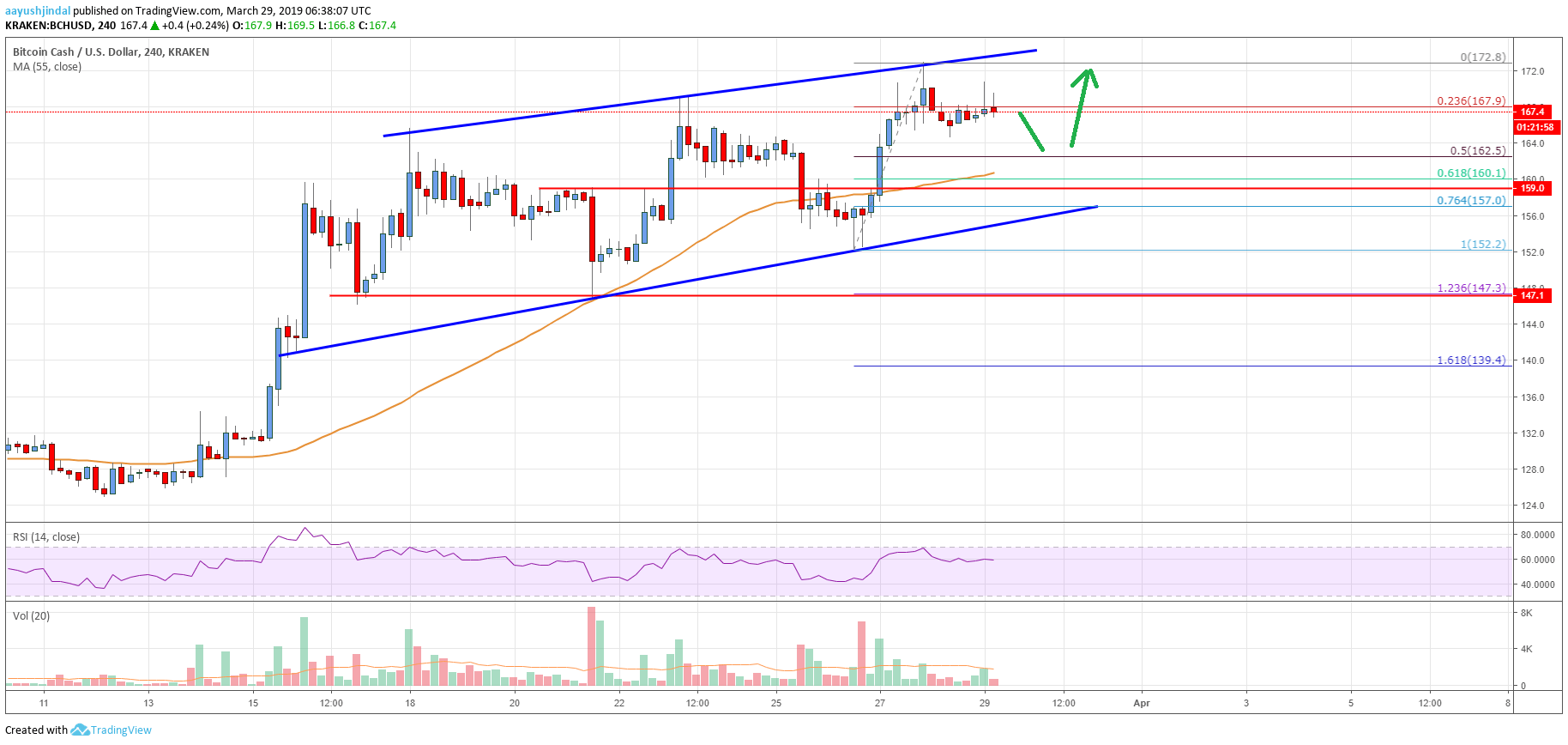

- There is a crucial ascending channel formed with support at $157 on the 4-hours chart of the BCH/USD pair (data feed from Kraken).

- The pair is currently correcting lower, but dips remain supported near $162.5 and $157.0.

Bitcoin cash price remained in a strong uptrend above the $160 level against the US Dollar. BCH even broke the $170 level and it is currently correcting lower towards key supports.

Bitcoin Cash Price Analysis

Buyers remained in action this week, with positive moves in bitcoin, ripple, Ethereum, and bitcoin cash against the US Dollar. Earlier, the BCH/USD pair corrected lower from the $168 resistance level. It broke the $160 and $155 support levels. However, losses were limited and later the price bounced back from the $152 support. There was a strong upward move above the $154 and $155 resistance levels. Finally, there was a close above $164 and the 55 simple moving average (4-hours).

A new monthly high was formed near the $172 level and recently the price corrected lower. The price declined below the $170 level and the 23.6% Fib retracement level of the last wave from the $152 swing low to $172 high. The current price action suggests more range moves below the $170 and $172 resistances. On the downside, an immediate support is near the $162.5 level. It represents the 50% Fib retracement level of the last wave from the $152 swing low to $172 high.

There is also a crucial ascending channel formed with support at $157 on the 4-hours chart of the BCH/USD pair. The main support is near the $160 pivot level. Besides, the 61.8% Fib retracement level of the last wave from the $152 swing low to $172 high is also near $160. Finally, the 55 simple moving average (4-hours) is also near the $160 level. Therefore, if there is a downside correction, the price may find bids near $162.5 or $160.0.

Looking at the chart, bitcoin cash price is placed nicely in a significant uptrend above the $160 support area. In the short term, there could be a downside correction towards $165 or $162. However, buyers are likely to remain in action as long as the price is above $160. On the upside, the main hurdles are $170, $172 and $180.

Technical indicators

4 hours MACD – The MACD for BCH/USD is currently placed in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for BCH/USD is currently well above the 55 level, with a flat bias.

Key Support Levels – $165 and $160.

Key Resistance Levels – $172 and $180.