- Bitcoin price recovered recently and traded above the $4,000 level against the US Dollar.

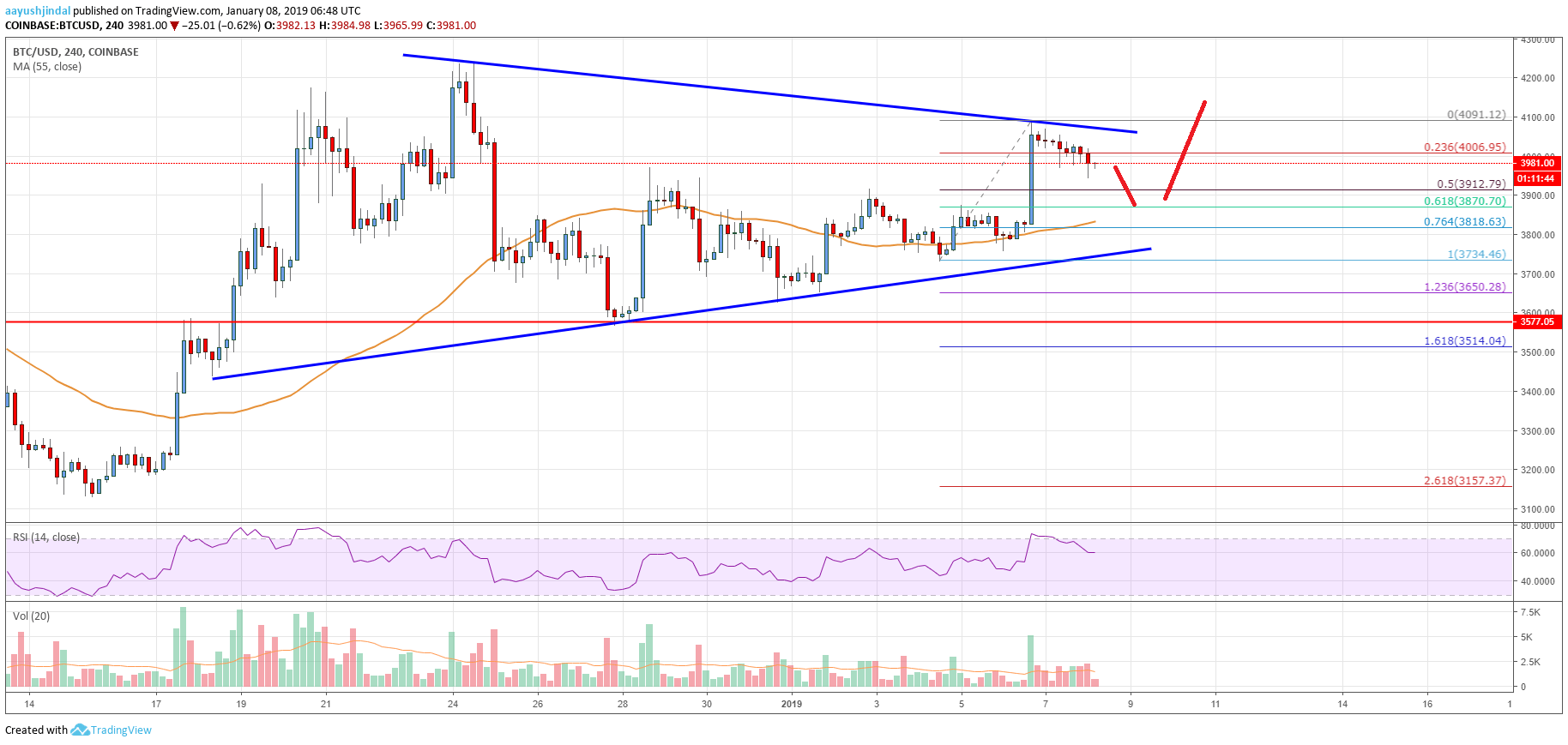

- There is a major contracting triangle formed with resistance at $4,060 on the 4-hours chart of the BTC/USD pair (data feed from Coinbase).

- The price may dip a few points towards the $3,820 support before the next upward move.

Bitcoin price is slowly correcting lower from the $4,091 high against the US Dollar. BTC could decline towards the $3,870 or $3,820 support before climbing higher once again.

Bitcoin Price Analysis

This past week, there was a slow and steady rise in bitcoin price from the $3,735 swing low against the US Dollar. The BTC/USD pair traded above the $3,800 and $3,900 resistance levels. There was even a close above the $3,800 support and the 55 simple moving average (4-hours). Later, the price broke the $4,000 level and traded as high as $4,091. Finally, sellers appeared and later the price started a downside correction below $4,050.

The price recently declined below the 23.6% Fib retracement level of the last wave from the $3,734 low to $4,091 high. However, there are many supports on the downside, starting with $3,912. It represents the 50% Fib retracement level of the last wave from the $3,734 low to $4,091 high. If there is a break below $3,912, the price may test the $3,820 support and the 55 simple moving average (4-hours). An intermediate support is at $3,870 and the 61.8% Fib retracement level of the last wave. Therefore, if there is a downside push, the price may find bids near $3,912, $3,870 and $3,820. More importantly, there is a major contracting triangle formed with resistance at $4,060 on the 4-hours chart of the BTC/USD pair.

Looking at the chart, bitcoin price remains well supported above the $3,820 support. If buyers fail to defend the $3,820 support and the triangle support, the price may decline to $3,570.

Technical indicators

4-hour MACD – The MACD for BTC/USD is placed in the bearish zone, with a few bearish signs.

4-hour RSI (Relative Strength Index) – The RSI is currently moving lower towards the 50 level, indicating a short term correction.

Key Support Level – $3,820

Key Resistance Level – $4,060