Bitcoin SV is gaining a lot of bullish traction after the hard fork and its debut on CoinMarketCap. Currently, it has climbed to the 7th spot in terms of market cap and is showing technical signals for further gains.

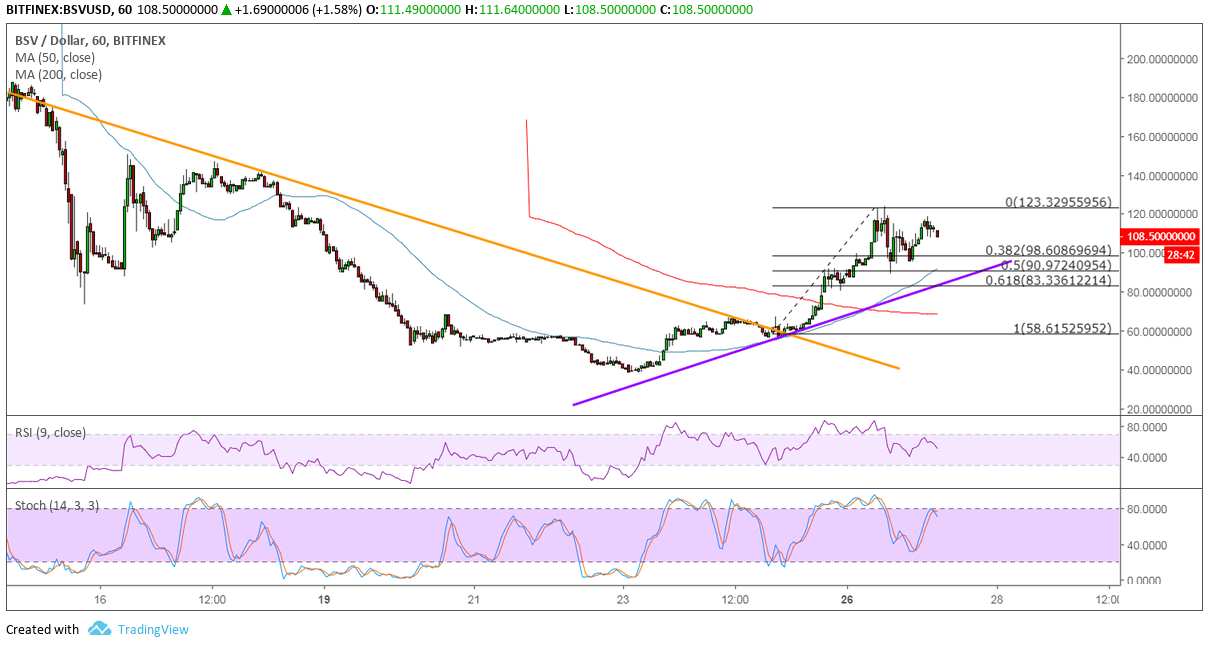

For one, price broke through a short-term falling trend line connecting the highs since last week. Price is starting to form a new rising trend line since but might be due for a quick pullback.

Applying the Fibonacci retracement tool on the latest swing low and high shows that the 50% level is closest to this new trend line while the swing low is nearer to the broken descending trend line, which could serve as the line in the sand for a correction. Price already seems to have found support at the 38.2% Fib and might be ready to resume the climb to the swing high and beyond around $123.

The 100 SMA has crossed above the longer-term 200 SMA to signal that the path of least resistance is now to the upside. In other words, the uptrend is more likely to resume than to reverse. The 100 SMA is also near the rising trend line to add to its strength as a floor in the event of a dip.

RSI is turning lower, though, indicating that sellers might take over while buyers take it easy. Stochastic is also starting to top out, reflecting exhaustion among bulls and a potential return in bearish momentum.

Bitcoin SV is the brainchild of Dr. Craig S Wright and his company, nChain, opposing the Bitcoin ABC development team. Keep in mind, however, that ABC has drawn more support from the network and that SV has recently been having some technical problems in the past week. If the team is able to square away these issues, such as hours between blocks and some blocks crashing nodes after propagation, the upside moves could gain more traction.

Images courtesy of TradingView