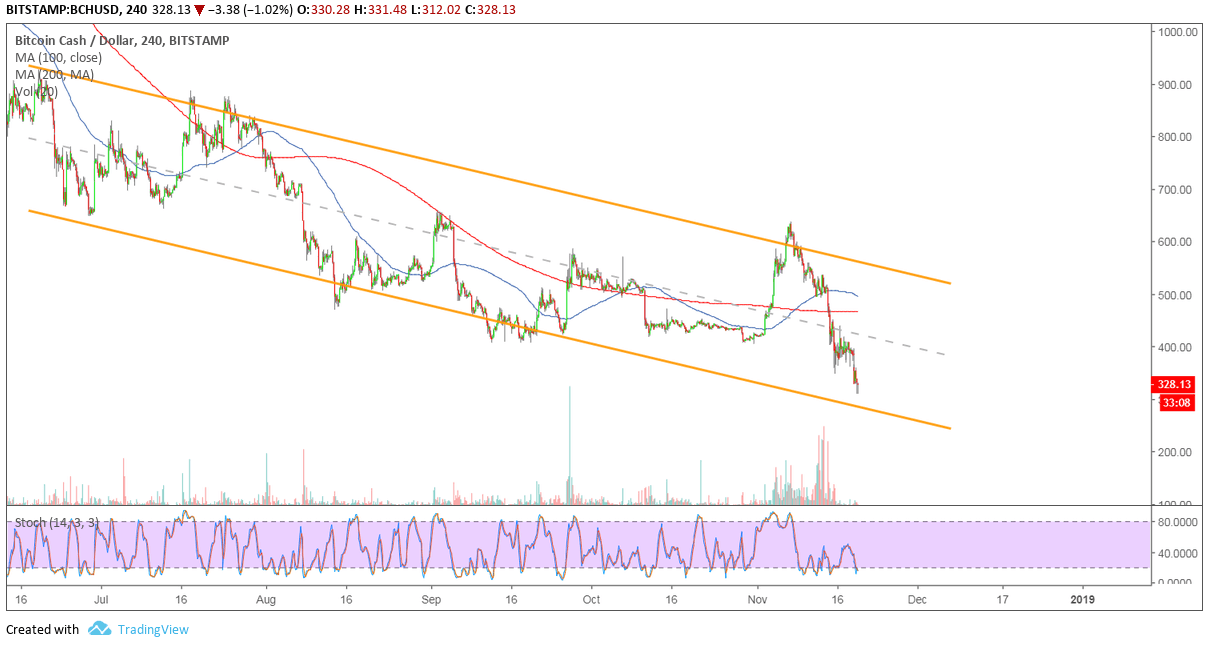

Bitcoin Cash is still trending lower inside its descending channel on the 4-hour time frame and is approaching support. A bounce might take place if buyers defend this level, but another move lower could spur a steeper slide.

The 100 SMA is above the longer-term 200 SMA to signal that the path of least resistance is to the upside. This suggests that support is more likely to hold than to break. If so, Bitcoin Cash could find its way back up to the channel top around $500 or the mid-channel area of interest and former near-term support at $400.

Stochastic is also dipping into the oversold region to signal that bearish pressure is fading. Turning higher could allow bullish momentum to return and support levels to hold. Volume has ticked lower, though, and might remain so as the Thanksgiving holidays approach.

Bitcoin Cash has been on the decline as the hard fork has spurred a “mining war” while the community struggles to reach a consensus on which version to support. This has spilled over to other cryptocurrencies and continues to keep a lid on price gains.

According to Roger Ver, Bitcoin ABC is ahead in the hash war versus Bitcoin SV by 53.5% in terms of Proof of Work. In a video, he stated:

The actions taken by BSC are opposite to how cryptocurrencies should function. Claiming you are Satoshi and then threatening to sell everything to destroy the cryptocurrency is a lot like a kid who just lost a basketball game and walks away with the ball.

Meanwhile, some exchanges have expressed support for either or both versions while stating risks involved, which likely explains the low volume as investors are holding out for more clarity. For instance, a post on Kraken states:

Bitcoin SV does NOT meet Kraken’s usual listing requirements. It should be seen as an extremely high risk investment. There are many red flags that traders should be aware of.

Images courtesy of TradingView