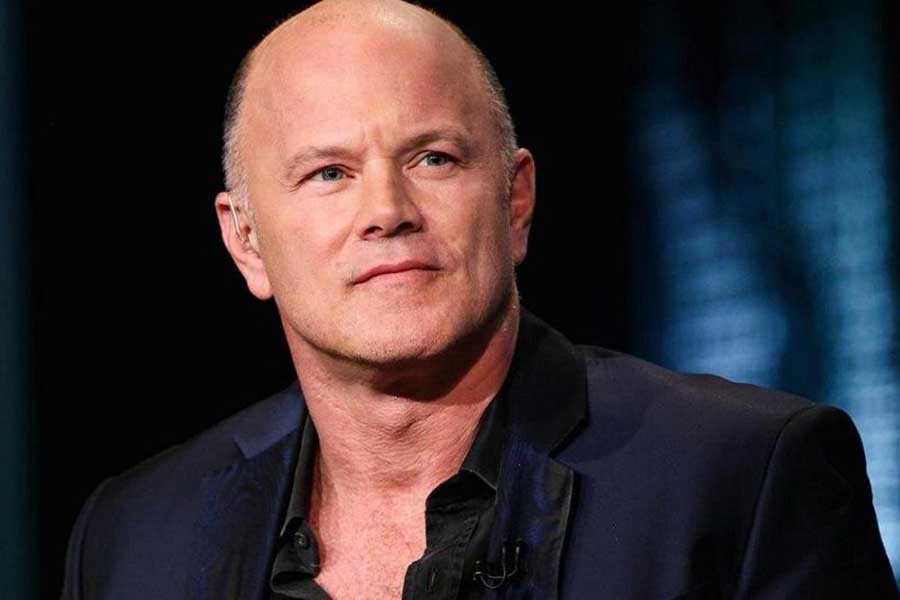

High-ranked officials are leaving Mike Novogratz’s digital assets merchant bank Galaxy Digital as the company is pivoting away from small-scale ICOs to larger institutions.

‘Capitalize on the Changing Landscape’

After suffering a major $134 million hit in the first quarter of 2018 alone, Mike Novogratz-owned digital asset merchant bank Galaxy Digital is reportedly making a pivot in its market approach.

According to the Bitcoin permabull, the company is adapting to the regulatory framework as well as to the opportunities that it currently envisions. As such, it will be shifting from small-scale ICO advisory and blockchain consulting to serving larger institutional clients.

Speaking on the matter, Novogratz said:

The industry underlying digital assets and blockchain technology continues to evolve. We remain optimistic on the space overall yet recognize we need to reposition our Company to capitalize on the changing landscape.

Furthermore, Galaxy Digital will also be shutting down its office in Vancouver, reposition personnel to the team headquartered in New York.

Fleeing a Sinking Ship?

High-ranked officials from the company are reportedly leaving their positions following the pivot. Richard Tavoso, who has been acting as the President of the crypto-asset bank will be transitioning out of his role by the end of the year. He will supposedly continue to work with the company, though, as he’ll become a trusted advisor, as well as a member of the Board of Managers.

On the other hand, David Namdar, who’s the current Co-Head of Trading, is leaving the company entirely in order to “pursue other opportunities.”

Commenting on the leaves, Novogratz notes:

I would like to thank Richard Tavoso and David Namdar for all of their work and support in helping to launch and build our Company. […] I look forward to continuing to work with both, Richard as a Director at Galaxy and David, as a key member of the crypto community.

What do you think of the current pivot and overall state of Galaxy Digital? Don’t hesitate to let us know in the comments below!

Images courtesy of ShutterStock and Flickr.