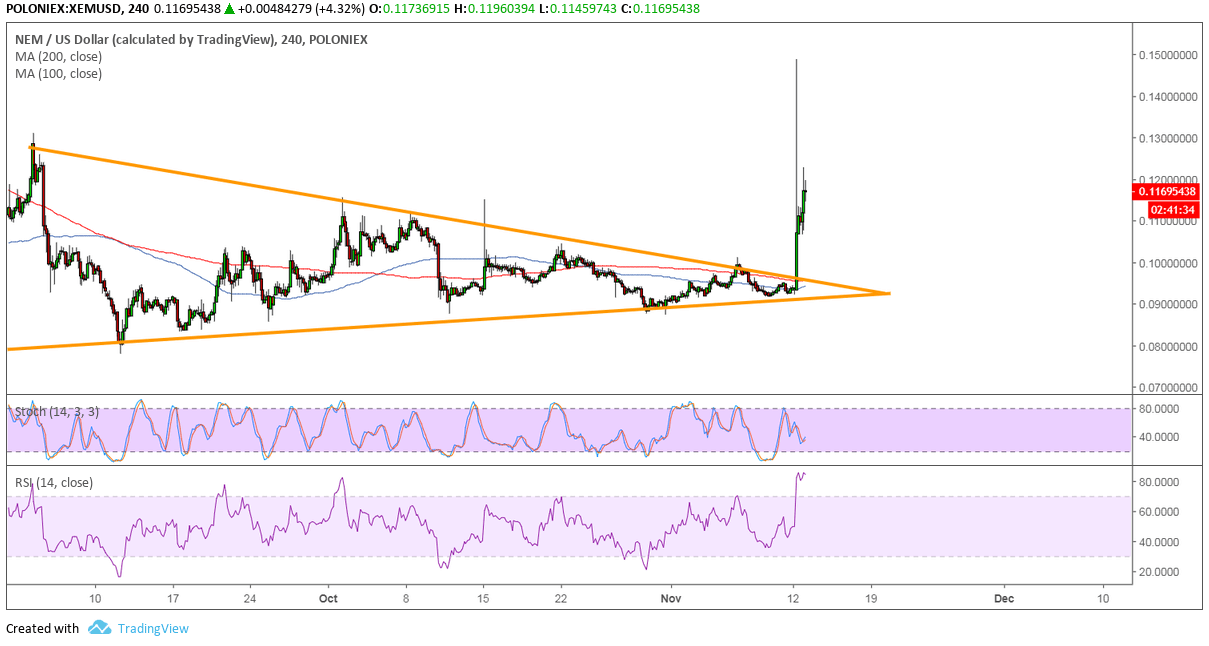

NEM was previously consolidating inside a symmetrical triangle pattern with its higher lows and lower highs, but the price just recently busted through the top. This bullish breakout suggests that an uptrend is in the works, possibly lasting by the same height as the triangle formation.

However, the 100 SMA is still below the longer-term 200 SMA to indicate that the path of least resistance is to the downside. This suggests that there’s still a chance for sellers to return, although it could be that the indicators have yet to catch up to the latest move. Price is above these dynamic inflection points, after all, an early signal that bulls have won over.

Stochastic is pointing down to indicate that selling pressure could pick up. This could lead to a pullback to the broken triangle top or any nearby support zone where more buyers could join in to sustain the rally. RSI is already in the overbought zone to signal exhaustion among buyers, and turning lower could lead bearish pressure to return.

The recent surge is being pinned on the announcement that Coincheck, a leading Japanese exchange platform, will be resuming their trading services for the coin today, November 12. As the NEM team noted on their site:

Coin Check Co., Ltd. resumed new account opening and payment / purchase of some virtual currencies on October 30, 2018, With regard to ETH, XEM and LSK, technical safety confirmation has been completed with the cooperation of external experts and we have resumed payment / purchase of the virtual currency from November 12, 2018 I will inform you that.

NEM was pivotal in helping this exchange recover from a large hack earlier on, as the team employed the mechanism to track wallets which had stolen funds. This could have potential applications for other exchanges down the line, which is likely why market attention is spiking for NEM these days.

Images courtesy of TradingView