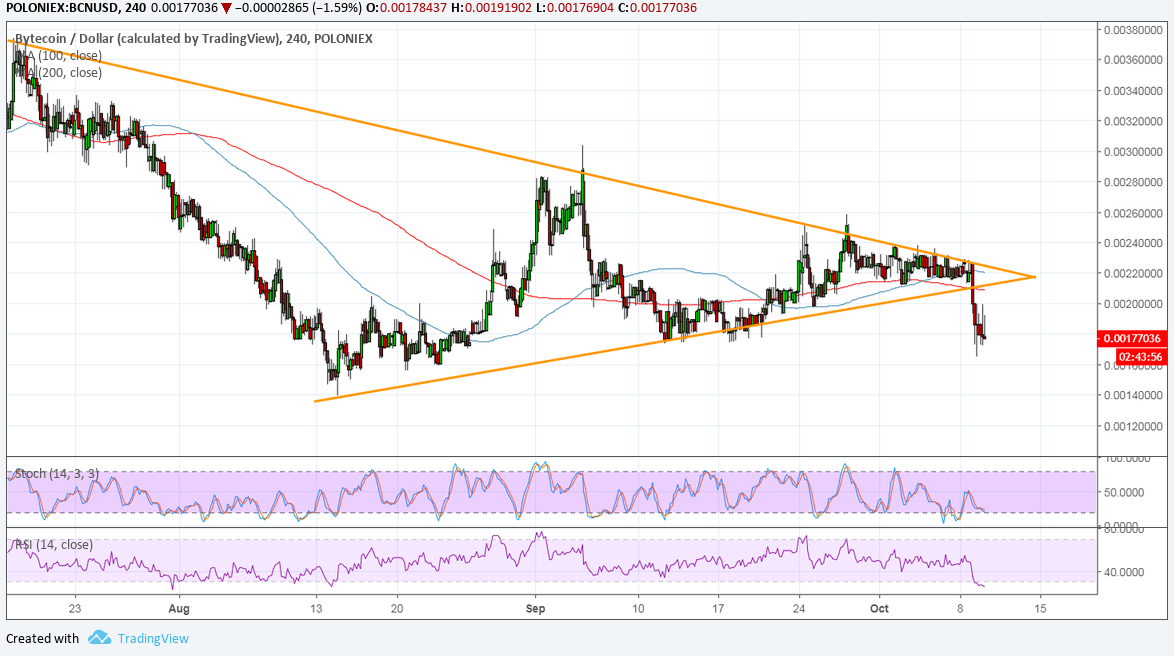

Bytecoin was previously consolidating inside a symmetrical triangle visible on its longer-term charts before a sharp downside break ensued. This is being pinned on the altcoin’s delisting on Binance, although a number of other factors have also been dragging cryptocurrencies lower in the past 24 hours.

The 100 SMA is above the longer-term 200 SMA to signal that the path of least resistance is to the upside. This suggests that the climb could still resume at some point, although it could also mean that these indicators have yet to catch up to the sharp move. This downside move could mean that a drop of the same height as the chart pattern could be underway.

Stochastic is heading lower to signal that sellers still have control, likely pushing price further south. Then again, the oscillator could pull up from the oversold region later on and bring more buyers back in. RSI has also dipped into oversold territory and turning higher could lead to a retest of the broken triangle support.

Bytecoin has tumbled more than 20% as Binance announced:

In order to protect our users, the Binance team conducts comprehensive and periodic reviews of each digital asset listed on our platform to ensure projects maintain a high standard of quality. In the event a coin or token falls below this quality standard, it will be subject to further review and potentially delisted.

The delisting included Bytecoin (BCN), ChatCoin (CHAT), Iconomi (ICN), and Triggers (TRIG). Withdrawals are still supported until 2018/11/12 10:00 AM (UTC).

It didn’t help that the mood in the cryptocurrency has been somber after the IMF also warned in its World Economic Outlook:

Cybersecurity breaches and cyber attacks on critical financial infrastructure represent an additional source of risk because they could undermine cross-border payment systems and disrupt the flow of goods and services. Continued rapid growth of crypto assets could create new vulnerabilities in the international financial system.

Images courtesy of TradingView