IOTA continues to trend lower against bitcoin as it tests the resistance of its falling channel on the 1-hour time frame. Price is consolidating in a small symmetrical triangle, though, and its breakout direction could determine its next longer-term move.

A candle closing below the triangle support could provide enough bearish momentum for a move down to the channel support around 0.00017. The 100 SMA is below the longer-term 200 SMA to suggest that the path of least resistance is to the downside or that a selloff is more likely to happen than a rally.

In addition, the 200 SMA lines up with the falling channel resistance to add to its strength as a ceiling. Stochastic is heading up but nearing overbought conditions to signal a return in selling pressure. RSI has a bit more room to climb so IOTA could still test the channel resistance before heading lower.

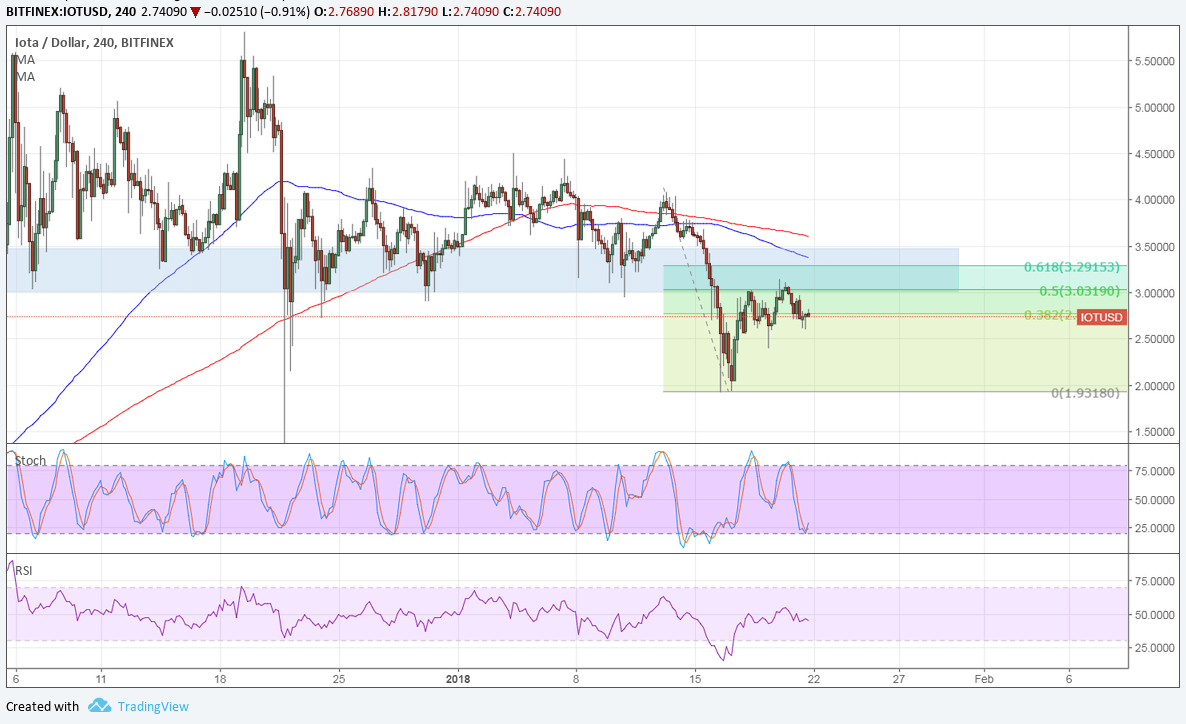

Against the dollar, IOTA appears to have bounced off the area of interest at the 3.000 mark. This lined up with the 50% retracement level, so price might be on its way back down to the swing low at 2.000 or lower.

However, stochastic is indicating oversold conditions and looks ready to turn higher. In that case, buyers could still attempt to keep IOTA afloat and lead to a larger correction to the 61.8% Fib level.

The 100 SMA is still below the longer-term 200 SMA, though, so the path of least resistance is to the downside. The gap between the moving averages is even widening to indicate a pickup in selling pressure. Also, these moving averages are close to the area of interest to add to its strength as a ceiling.

Then again, the dollar is on weak footing owing to the US government shutdown, which could bring in enough risk aversion to spur stronger demand for cryptocurrencies like IOTA. The longer the shutdown goes on, the more weight on US assets and the currency and the stronger potential to lift alternative assets.