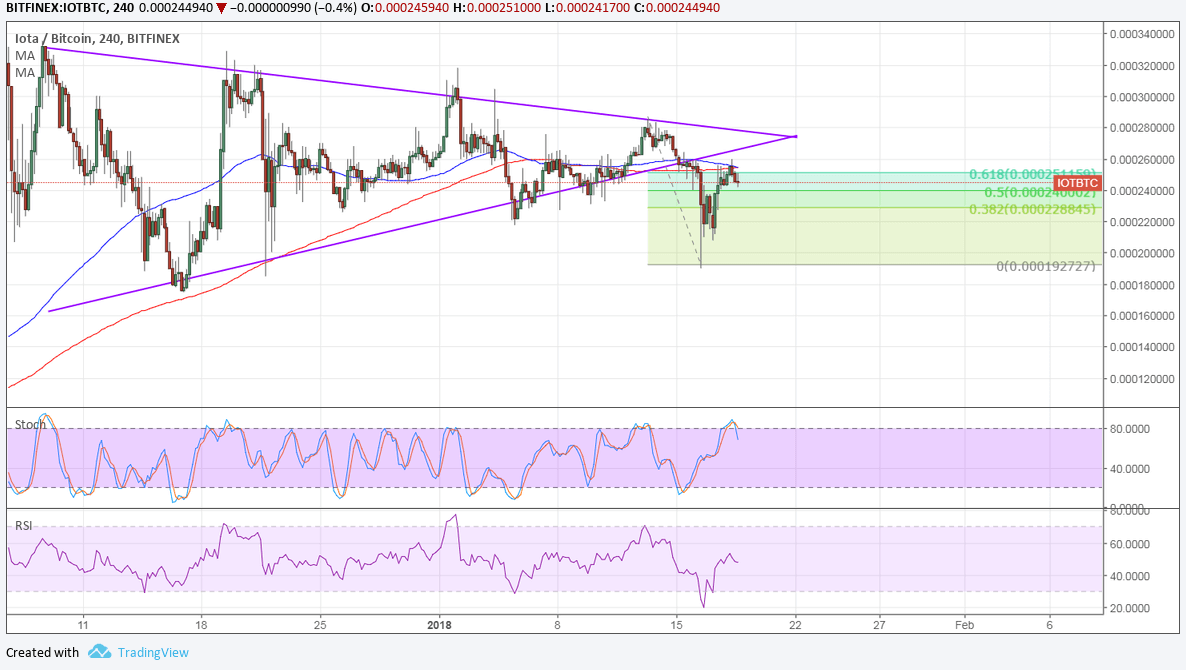

IOTA has recently broken below its consolidation pattern to bitcoin and its range to the dollar. Corrections appear to be in play before selling pressure picks up again.

Against bitcoin, IOTA is testing the 61.8% Fibonacci retracement level on the breakdown move and looks ready to head back to the swing low at 0.0002. The moving averages are currently keeping gains in check.

Speaking of moving averages, the 100 SMA is starting to cross below the longer-term 200 SMA so the path of least resistance is to the downside. In other words, the selloff is more likely to resume or reverse. Stochastic is turning lower from the overbought region to indicate a pickup in selling pressure as well.

RSI, on the other hand, has some room to climb so buyers could still put up a fight. A move past the triangle bottom or resistance could indicate that bullish momentum is picking up.

Against the dollar, IOTA is also in correction mode and is hovering around the 50% Fib on the breakdown move. This also appears to be keeping gains in check as it lines up with the 100 SMA dynamic inflection point.

The 200 SMA is closer to the 61.8% Fib at 3.300, but since the gap between the moving averages is widening, selling pressure could keep picking up and take IOTA to the swing low below 2.000.

Stochastic is on the move down to confirm that selling pressure is present, and so is RSI. However, the former is closing in on the oversold region to reflect exhaustion.

Note that the dollar is being weighed down by the prospect of a government shutdown if the funding bill isn’t passed. This might lead, not just to dollar weakness, but also a pickup in risk aversion which is usually positive for cryptocurrencies.

Apart from that, there is also some degree of geopolitical risk stemming from the political troubles in Germany as Merkel is struggling in her attempt to strike a coalition.