Even though bitcoin price recorded an astonishing high of $20,000 on December 17, 2017, the bullish wave, that has been controlling the market during December, was broken right after this new historical high has been recorded. Bitcoin price has been dropping during the past period to record $13,410 during the time of writing of this article, losing around 35% of value in around 7 days. So, why is bitcoin price dropping?

(Note: I won’t try to go through technical analysis of the charts when trying to look through reasons underlying the current drop in bitcoin price. Instead, I will discuss 2 main reasons related to problems associated with bitcoin as a currency)

Network Congestion:

The rise in the price of bitcoin has been accompanied by a steep increase in the number of transactions handled by the network. This led to big delays in transaction confirmation and some transactions would be confirmed and included in blocks days after the transactions have been actually executed. The number of delayed unconfirmed transactions has been steadily rising during the past month and at this moment, there are 176595 unconfirmed transactions, as blockchain.info provides a live ticker of the number of unconfirmed transactions.

So, one would send a payment and its receiver would only be able to spend it after 2-3 days (after the transaction is confirmed and included in a block) and with the current high volatility of bitcoin, the value of the payment can be markedly altered after confirmation. This caused some to avoid bitcoin payments and shift to other cryptocurrencies whose networks are less congested.

Transaction Fees:

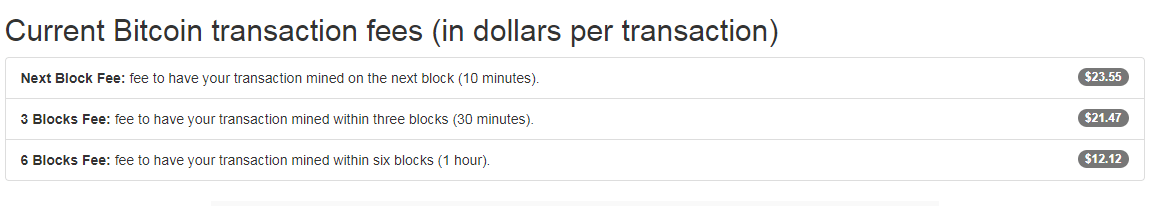

If bitcoin was once the payment method with the least transaction fees , this is currently far from being true. The network congestion and the rise in the number of “piled up” unconfirmed transactions have led to a sharp rise in transaction fees. The fees for a given transaction isn’t related to the amount of coins conveyed via the transaction, but rather on the space occupied by the data representing the transaction on the block onto which it is included. Transaction fees are calculated on a “satoshi per byte” basis. For example, if the fees needed to send a transaction and get it confirmed within the next 2 blocks ( within around 20 minutes) are 1,002 satoshi/byte, so with an average transaction size of 250 bytes, the total fees equal 250,505 satoshis which means that you will be paying a $33.59 (BTC = $13,410) fee for your transfer whatever the value of your transaction is. As miners can choose which transactions to mine first and include in the next block(s), senders can increase the paid fee to prioritize the confirmation of their transactions.

According to bitcoinfees.com, a site that shows a live estimate of bitcoin transaction fees, the least fee one can pay now to send a bitcoin transaction is $12.12, which is the fee needed to get your transaction confirmed and included within the next 6 blocks.

So, with this, bitcoin is now not suitable for sending micropayments which was one of the main reasons why online entrepreneurs relied on bitcoin as an ideal payment method for micro-jobs or small online gigs. Being in the online publishing business, I have seen many webmasters shift from Bitcoin to other cryptocurrencies for paying their full time workers, and seasonal freelancers.

In my opinion, the network congestion and the high transaction fees are the main technical reasons that are fueling the current bearish wave. People who have been using bitcoin as a method of payment are the ones who are suffering from the current network status, and are the ones who are mostly selling their bitcoins for other currencies that can be more suitable for their needs. On the other end of the spectrum are investors who are using “bitcoin” as an investment commodity, or for storage of value, who buy the coins and keep them in their wallets, so they won’t care much about the current network problems.