Even though bitcoin has introduced a new concept of decentralized cryptocurrencies, the inevitable consolidation of mining into mining pools, that control enormous portions of the network’s hashing power, is a problem that undermines the decentralized nature of the protocol. On the other hand, scalability and the inconveniently long transactions’ conformation delays represent another problem that hurdles popularization of bitcoin.

A recently published paper proposed to forgo the blockchain and the blocks entirely, and formulate a truly decentralized ledger system which relies on a lean graph which is comprised of “cross-verifying” transactions. A fully decentralized consensus mechanism, which relies on progressive proofs-of-work (PoW) with predictable rewards, guarantees rapid convergence even throughout a huge network with unequal participants, who all get incentivized for mining using their mining equipment which possess variable hashing power. Graph based affirmation endorses concise response via a process of automatic scaling. On the other hand, application agnostic design is compliant with all of cryptocurrencies’ modern features including swaps, multiple denominations, scripting, securitisation, smart contracts….etc.

The authors of the paper proved experimentally that their proposal achieves a pivotal convergence property. In other words, any valid transaction enters the system will rapidly become included in a block and linked to the proceeding blocks.

Mining Pools and Centralization:

Bitcoin’s scalability represents an artefact that stems from the consolidation principle of the blockchain itself, which renders it very hard to distribute incentives to the large group of participants contributing, or would have been contributing, their processing power to bitcoin mining. When a linear blockchain is considered, the mining rewards are somehow few and relatively far between, and the sole secure and fair way to distribute them is literally a lottery.

Risk averse miners coalesce into bitcoin mining pools to decrease the variance, at the cost of relinquishing their individual chances to find the solution to the puzzle. This renders the network more vulnerable to a myriad of attacks; the well known 51% attack and the selfish miner, or the 33% attack, which can occasionally become a 25% attack. The problem is that mining pools have transformed into monopolies within the bitcoin system. Recent data denote that 50% of bitcoin’s network hashing power originates from mining pools that are located in China.

Bitcoin’s Scalability and Long Confirmation Times:

Sometimes, people had to wait for more than 24 hours to get their bitcoin transactions confirmed. A long and/or unpredictable confirmation time renders people reluctant to use bitcoin for real time payments with considerable amounts of money. Ironically enough, retailers accepting bitcoin payments now overcome confirmation delays via utilization of payment processors, or third parties which bitcoin was designed to omit!

The New Approach – A Blockchain Free Cryptocurrency:

The new proposal represents a blockchain free cryptocurrency, as confirmation of transactions no more yields a blockchain of transactions, but a lean graph that is entirely composed of transactions; a graph of cross verifying transactions.

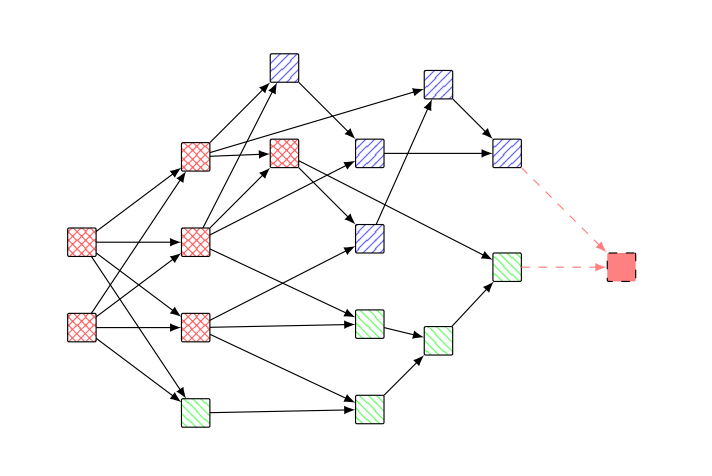

Whenever a transaction is posted, it will refer to the actual coins paid, as well as two proceeding confirmed transactions. This will lead to a growing group of “hash-graph” confirmations, where each transaction confirms two “parent” transactions. The below figure shows how transactions are connected, or refer to each other. The arrow originates from a “parent” transaction and points to a “child” transaction.

Conclusion:

This proposal establishes the concept of a cryptocurrency without using the traditional blockchain system, which mitigates the scalability issues associated with blockchains and avoids centralization problems that are inseparable parts of blockchain implementations. I believe that this represents a crucial improvement in this research field and will be warmly welcomed by crypto-entusiasts.

Diagrams are Courtesy of Cryptology ePrint Archive: Report 2016/871