Forex traders are quite often advised to switch to an ECN brokerage. This is because ECN platform provides a wide range of benefits to all kinds of traders. However, it can be unclear what makes ECN stand out in comparison to Market Makers for example. Thus, our goal is to clarify the key features of the ECN broker. Let’s go.

What is ECN?

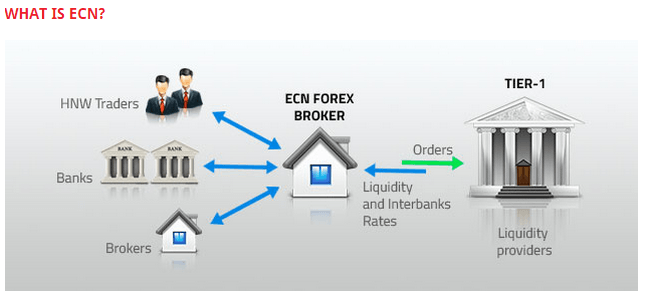

The abbreviation “ECN” stands for the Electronic Communication Network. The technology behind ECN allows the broker to get the liquidity and the real market quotes directly from the liquidity providers. The liquidity providers are usually banks and other brokers like Market Makers. ECN broker connects retail traders with the market, thus not intervening in the actual trading.

ECN brokers offer tight variable spreads or even zero spreads for the order execution. The main source of revenue for ECNs is the commission. It is charged for every trade conducted with the ECN broker. Although this might increase the trading costs, the advantages that ECN delivers are definitely worth it.

ECN Advantages

Well, the first major advantage of dealing with the ECN brokerage is full security and anonymity. Despite the fact that the ECN broker sends the client’s orders to the liquidity provider, the broker does not reveal the personal information of the trader. This makes trading process unbiased and safe.

Another benefit is the swift order execution. Unlike Market Makers, ECNs do not trade against their clients. Instead, they provide a technologically advanced network for placing the orders. The broker acts as the middleman here, simply passing your orders as soon as possible to the liquidity provider.

The third advantage will tell you more about ECN brokers here. When it comes to trading with ECNs, there is no restriction of trading techniques utilized by the trader. The prices provided by ECNs are more volatile than at Market Makers, thus presenting more risk of loss. Nevertheless, the potential gain is increased as well, especially if the trader exploits some scalping strategies from his arsenal. Fortunately, scalping is not banned by the ECN brokers. Trading financial markets with ECNs allows traders to be versatile.

Requotes are very unpleasant for traders and obviously nobody wants to get them. Just to remind the term, a requote in FX trading happens when the broker is unable to provide the quote at which the trader has initiated the order. Hence, the price at which the order was placed would be different and might not be favorable for the trader. Thanks to the ECN real-time order processing, requotes are no longer the problem.

The Bottom Line

ECN remains the best option to choose for profitable Forex trading. Although ECN brokerages have their own downsides such as high fees, ECN model features bring the currency trading to a whole new level. Instant order processing, low spreads and safety of trades are just some of the many reasons why you should always go for the ECN brokerage.

Cover Image via Daily Forex