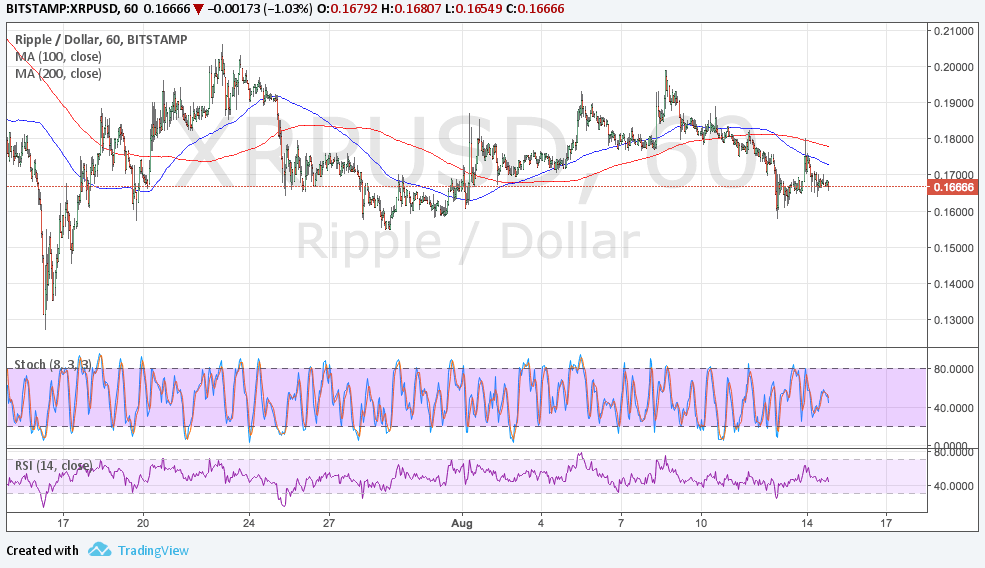

Ripple has been showing one bearish signal after another and it looks like a reversal formation is showing. A complex double top pattern can be seen as price failed in its attempts to break past the 0.2000 barrier recently.

Price is still testing the neckline around the 0.1600 area and a break lower could send it down by an additional 0.0400. The 100 SMA has crossed below the longer-term 200 SMA to signal that the path of least resistance is to the downside. In addition, these moving averages have held as dynamic resistance on the recent pop higher.

RSI is turning lower to reflect a return in selling pressure. Stochastic also looks ready to move down so Ripple might follow suit. Support is also located around the 0.1300 lows.

Dollar demand returned yesterday after US stock markets closed in the green at the start of the week. This was attributed to easing concerns about North Korea and optimistic remarks from New York Fed President Dudley. He mentioned that an announcement on the balance sheet runoff would be made soon and that keeping the current pace of growth could tighten the labor market and lift inflation slightly. He added that another rate hike for the year is still a possibility.

Meanwhile, cryptocurrencies have also been losing ground on the resurgence of bitcoin. Investors are putting more money in bitcoin due to the network upgrade that allows it to handle more transactions and the recent funding rounds for Coinbase and Filecoin.

Sustained investor interest in bitcoin could prop this particular digital asset higher while leaving its peers like Ripple eating dust. However, the US dollar also has to contend with the upcoming retail sales report and the release of the FOMC minutes this week. Cautious remarks from Fed officials could dampen September rate hike hopes, although traders are also keen to find out if the balance sheet runoff will start next month.